T

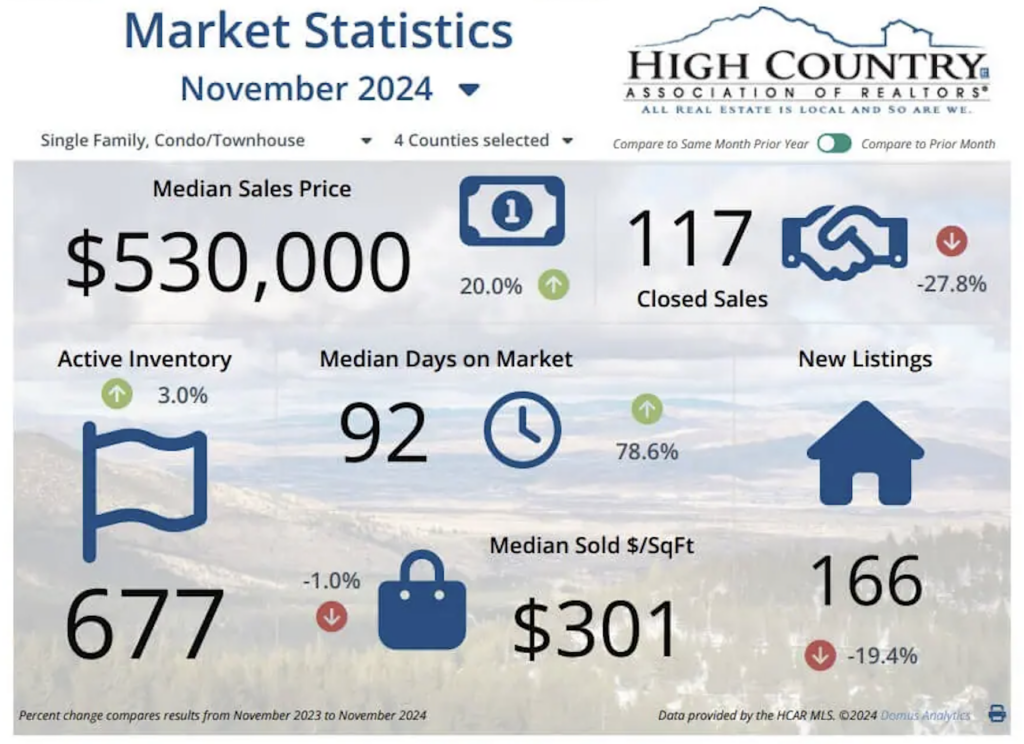

he High Country Real Estate Market in Alleghany, Ashe, Avery, and Watauga Counties experienced a 27.8% decline in sales compared to the same period last year. However, inventory increased by 3.0% during November. A total of 117 single-family and condo/townhouse properties were sold, with a combined closing value of $92 million. The median sales price for the four counties was $530,000, representing a 20.0% increase from last year.

Nationally, existing-home sales rose by 4.8% in November, marking the strongest year-over-year gain since June 2021. According to the National Association of Realtors, sales increased in three major regions and remained steady in the West.

Inventory levels in the High Country region stood at 677 active listings, with a 5.8-month supply. This represents a 42.7% increase from last year's inventory levels. New listings added during November totaled 166.

Land sales for the four counties reached $3.7 million in November, while commercial property sales totaled $1.5 million. Alleghany County reported nine residential sales with a median price of $399,900, and five land closings at a median price of $35,000. Ashe County saw 23 residential sales at a median price of $445,000, and 17 land sales at a median price of $44,000.

Avery County experienced the highest median sales price among the four counties, with $730,000 for 25 residential properties. Watauga County reported 60 residential sales at a median price of $534,800. Land sales in Avery and Watauga Counties totaled $50,000 and $46,750, respectively.

According to NAR Chief Economist Lawrence Yun, the economy's continued job growth and increasing housing inventory have led more buyers to enter the market, with mortgage rates stabilizing between 6% and 7%.