B

lackstone is on the verge of losing a $275 million securitized portfolio of four hotels under the Club Quarters brand as bondholders close in. The loan, taken out by Blackstone in 2017, landed in special servicing in 2020 and matured earlier this month without being paid off. Despite attempts to negotiate a workout agreement with CW Capital Management, the loan's maturity date was missed.

The hotels cater to business travel, which suffered significantly during the pandemic and has yet to fully recover. Blackstone initially took out a $275 million senior debt and a $61 million mezzanine loan in 2017 when the portfolio was valued at $423 million. A subsequent appraisal in October 2022 estimated its value at $360 million.

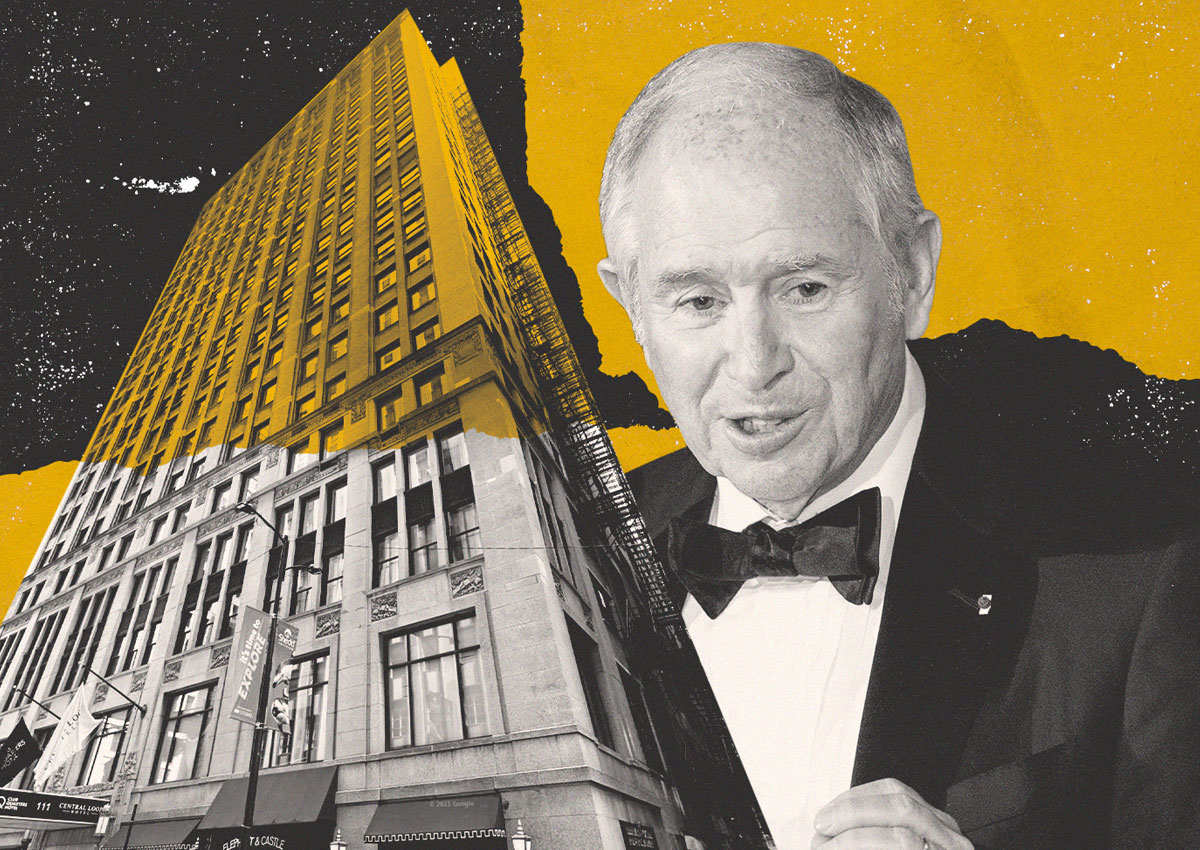

A lawsuit filed by Wilmington Trust, acting on behalf of CMBS bondholders, initiated foreclosure proceedings for one of the hotels in Chicago's historic Clark Adams building. The trust is also pursuing individual foreclosure actions against the three other Blackstone-owned Club Quarters hotels, with a Boston hotel already sold through a foreclosure auction for $75 million.

The prior owner of two properties in the portfolio, MasterWorks Development, could potentially regain control as they acquired the mezzanine loan backed by the hotels. However, it remains unclear what will happen next.