F

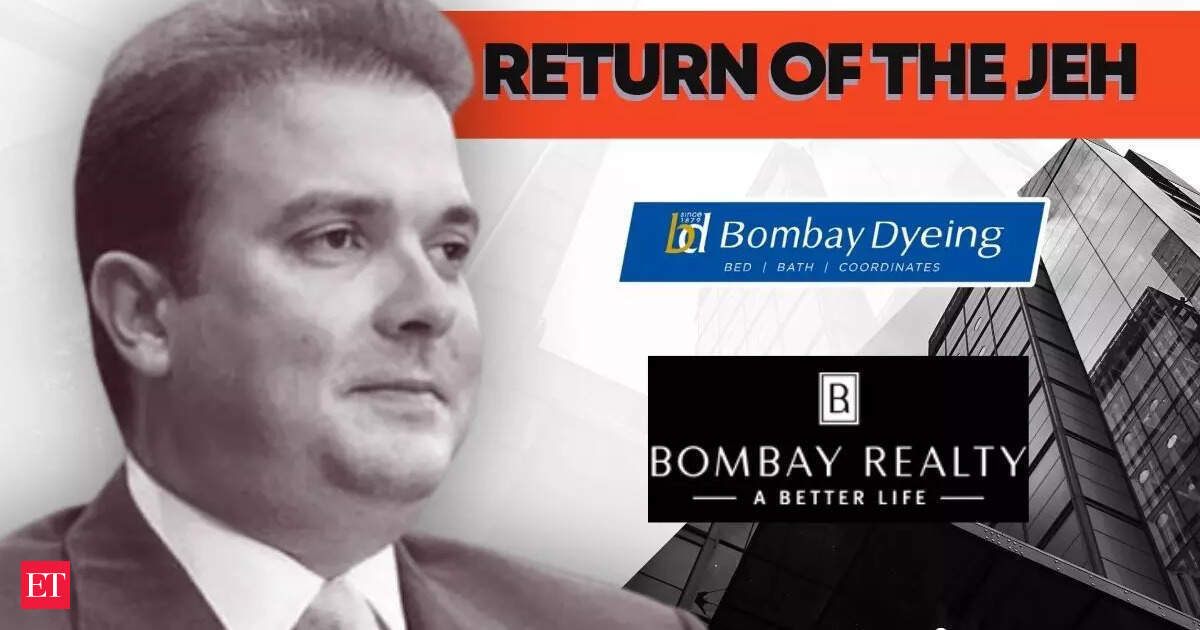

or over 145 years, Bombay Dyeing was a textile giant in India. However, the company is now undergoing a significant transformation, shedding its textile past to focus on real estate under the brand Bombay Realty. Jehangir 'Jeh' Wadia, 52, the younger son of industrialist Nusli Wadia, is leading this change. After a four-year hiatus, Jeh has returned with a clear mandate: to turn Bombay Dyeing's vast land bank into a thriving real estate business.

The shift isn't new; the Wadias have been in real estate since the early 1900s, initially building housing for Mumbai's Parsi community. However, their push into real estate gained momentum during the 2005-06 mill land boom, when they began developing their own land instead of just selling it. The company set up a dedicated real estate arm in 2008 and rebranded it as Bombay Realty in 2011.

Jeh's second stint at the helm is marked by a renewed focus on real estate. He sees the upcoming residential and commercial launches at Island City Centre (ICC) as a natural extension of their existing projects. The company has multiple parcels with a combined development potential of 3.5 million sq. ft., which Jeh believes will unlock significant value.

India's real estate sector is booming, driven by rising wealth and confidence. Luxury housing is particularly in demand, with homes priced above Rs 10 crore generating Rs 14,750 crore in the first half of 2025 alone. The market is expected to continue growing, with CREDAI projecting a 13-15% contribution to India's GDP by 2030.

Bombay Dyeing's biggest asset is its land bank, which includes prime plots in areas like Worli and Dadar. The company has sold some of this land for significant sums, including a Rs 5,200 crore deal with Japan's Sumitomo Realty in September 2024. More sales are expected to follow.

Jeh Wadia's plan is to unify the group's scattered real estate ventures under one banner, Bombay Realty. He aims to institutionalise their experience and create long-term value for shareholders. His approach involves a three-part filter: every project must fall into one of three buckets – strategic, financial, or exit – and only serve shareholder value.

With a combined market cap of Rs 1.38 lakh crore, the Wadia Group includes four listed companies: Britannia, Bombay Dyeing, National Peroxide, and Bombay Burmah. Jeh's immediate focus is to unlock value from land held across the group and within the family before partnering with external landowners through joint ventures.