T

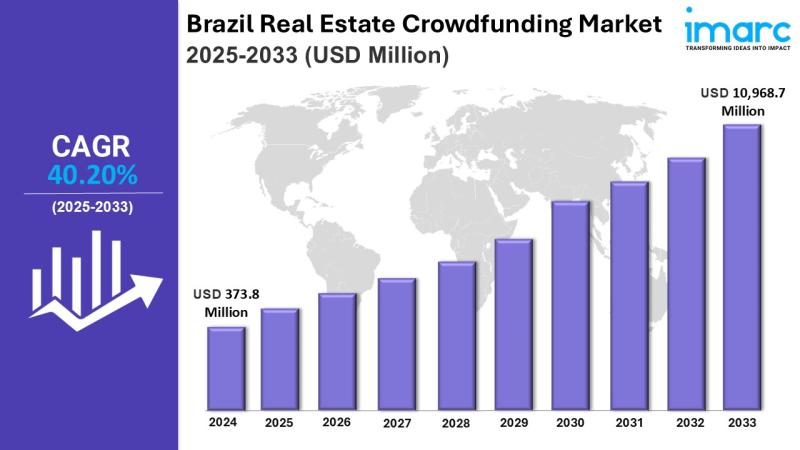

he Brazil real estate crowdfunding market is poised for significant growth, with estimates suggesting a rise from USD 373.8 million in 2024 to USD 10,968.7 million by 2033, at a compound annual growth rate (CAGR) of 40.20%. This expansion is driven by the proliferation of online investment platforms, reforms in regulations allowing alternative investments, and increased investor interest in diversified real estate portfolios.

The market's development is also bolstered by greater transparency, lower investment thresholds, and the attractiveness of real estate assets in a volatile economic environment. The industry is experiencing a shift towards digital investment platforms, enabling investors to participate in real estate projects with minimal capital requirements.

Key drivers of the market include rising urbanization, regulatory support for alternative investments, increasing property values, and growing investor interest in sustainable and green projects. The use of technology in investment procedures improves transparency and ease of access, further driving market expansion.

The Brazil real estate crowdfunding industry has a combination of local and foreign players competing on platform innovation, user experience, and diversification of projects. Major players are using technology to automate investment processes, improve transparency, and provide various real estate projects to appeal to a diverse group of investors.

Segmentations of the report include investor insights (individual and institutional), property type insights (residential and commercial), platform type insights (equity crowdfunding, debt crowdfunding, and hybrid crowdfunding), and regional insights (Southeast, South, Northeast, North, and Central-West).

Competitive Landscape:

The Brazil real estate crowdfunding market has a combination of local and foreign players competing on platform innovation, user experience, and diversification of projects. Major players are using technology to automate investment processes, improve transparency, and provide various real estate projects to appeal to a diverse group of investors.

Key Growth Drivers:

• Proliferation of digital investment platforms enhancing accessibility.

• Regulatory reforms supporting alternative investment avenues.

• Increasing urbanization driving demand for real estate assets.

• Rising property values offering attractive returns.

• Growing investor interest in sustainable and green projects.

• Lower investment thresholds broadening investor base.

Regional Insights:

• Southeast

• South

• Northeast

• North

• Central-West

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.