C

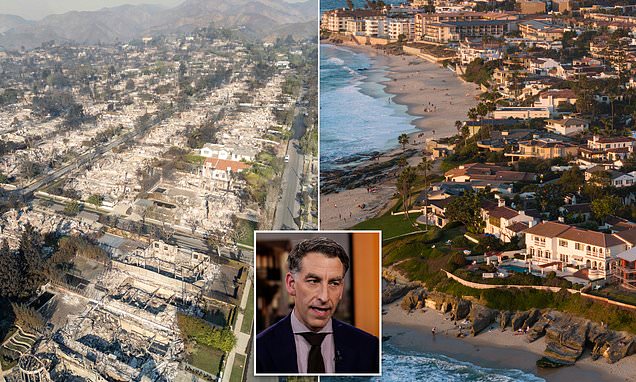

alifornia is facing a unique and daunting challenge, according to Redfin CEO Glenn Kelman. The state is grappling with soaring house prices, elevated interest rates, and rising insurance costs as it rebuilds from the devastating Los Angeles wildfires. This "triple threat" has never been seen before, Kelman warned.

The insurance crisis in California has worsened over the past few years, with major companies scaling back coverage or pulling out of the state entirely. The risk of natural disasters and increased business costs due to inflation have been cited as reasons for this trend. The estimated uninsured losses from the wildfires are at least $28 billion, exacerbating the situation.

Kelman attributes California's economic troubles to a combination of factors, including unprecedented home price increases during the pandemic, rising interest rates, and now increasing insurance costs. He hopes that the rebuilding process will lead to a crucial phase where the state can address its acute housing shortage and "NIMBY" attitudes that hinder development.

State Farm's decision to renew policies in the Pacific Palisades neighborhood and thousands more in Los Angeles County is seen as a positive step, but Kelman remains concerned that insurers may pull back further from California. He hopes that the damage from the fires will lead to a construction boom and a renewed focus on building homes, with President Biden potentially playing a key role in this effort.