D

are County residents are buzzing about the recent property revaluation notices, which revealed a staggering 67% increase in total property value to approximately $27.5 billion. This surge is largely attributed to the county's growing popularity and rising real estate market. As a result, many homeowners are bracing themselves for potentially higher tax bills.

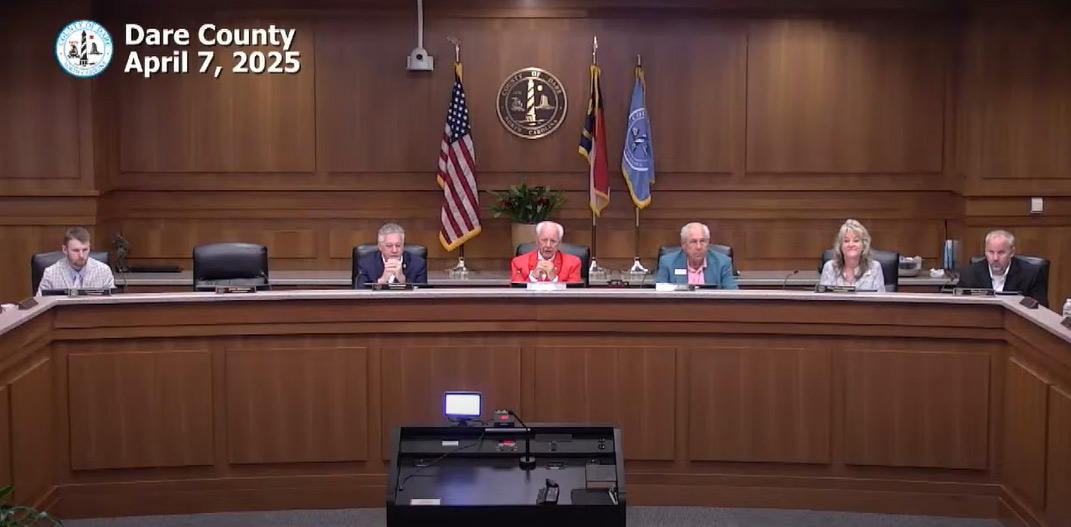

However, Dare County officials have announced that the tax rate will be significantly reduced to ensure revenue neutrality. Commissioner Chair Bob Woodard and County Manager Bobby Outten confirmed that the new tax rate will likely drop from 40.05 cents per $100 of value to 26.32 cents, a decrease of approximately 35%. This adjustment aims to keep the total tax collection steady despite the increased property values.

While some homeowners may still face higher tax bills due to rising property values, others may see their taxes decrease. The new tax rate will be finalized in June after the budget is approved. In the meantime, residents can expect a more manageable tax burden, thanks to the county's efforts to maintain revenue neutrality.

The Dare County Tax Appraisal Department has mailed out revaluation notices to all property owners, and officials are urging residents to review their assessments carefully. The new values will be used for tax purposes starting January 1, 2025.