T

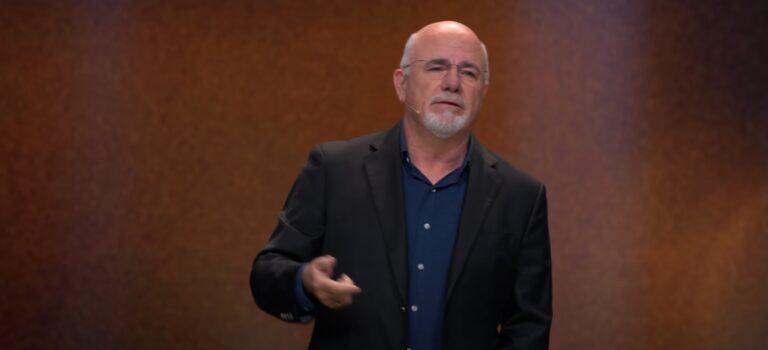

he recent interest rate cut by the Federal Reserve has set the stage for increased activity in the US real estate market. With 30-year fixed mortgage rates hovering near 6% and potentially dropping further, experts expect an uptick in home buying and refinancing. However, personal finance expert Dave Ramsey warns against taking unnecessary risks.

Ramsey suggests that refinancing a home can be a smart move for long-term homeowners by switching to a 15-year loan, paying off the mortgage faster and avoiding extra interest. He cautions against flipping houses to fund a new purchase, citing the challenges of managing such projects remotely. In a letter, Ramsey dismissed the idea of buying and flipping a house in another state, pointing out that successful house-flipping requires constant oversight.

Ramsey advises building a down payment fund through steady saving, budgeting, and possibly taking on extra work. He emphasizes the importance of financial patience and discipline, warning that shortcuts like remote property flipping can lead to more headaches than rewards. For those aiming to purchase a home, Ramsey advocates avoiding high-risk strategies and focusing on reliable savings.