T

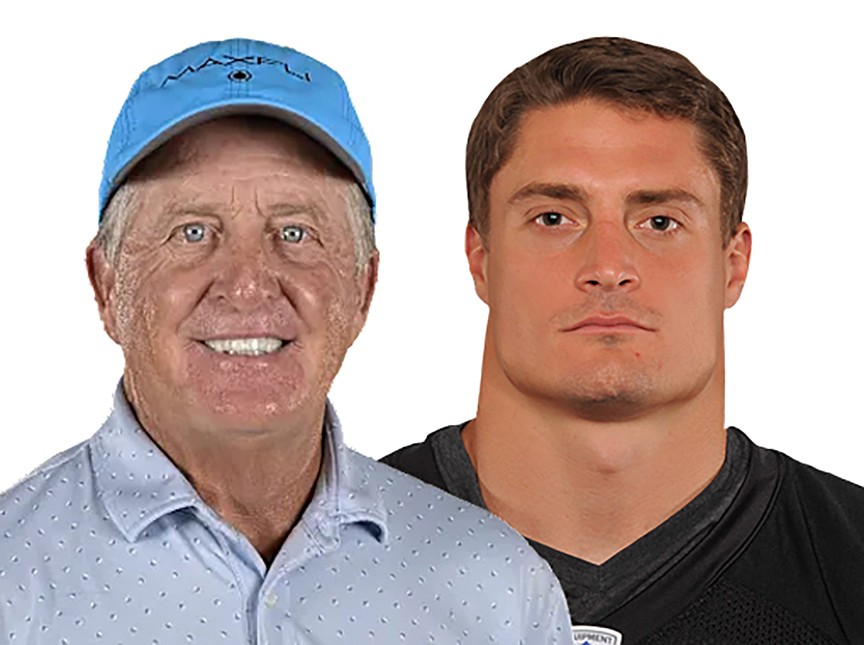

hinking big about residential real estate success demands a broad perspective on the industry as a whole. Industry Decoded features experts who shed light on issues affecting the market. The views expressed here are solely those of the author.In a move sparking outrage across the mortgage industry, Fair Isaac Corporation (FICO) has raised its wholesale royalty fee for credit scores from $3.50 to $4.95 per report, representing over a 40% increase. This significant price hike comes at a time when the industry is already grappling with economic headwinds, high interest rates, and an affordability crisis for homebuyers.Industry professionals see this as an example of unchecked power in a market where competition is scarce and consumers ultimately bear the cost.The backbone of mortgage underwriting: Credit report pricingTo understand the implications, it's essential to recognize the importance of tri-merge credit reports in the mortgage process. These reports pull credit data from the three major credit bureaus — Equifax, Experian, and TransUnion — and include a credit score that lenders use to determine borrower eligibility and loan terms. Historically, FICO's score has been the gold standard in mortgage underwriting, embedded in the process as a non-negotiable component.The typical cost of a tri-merge credit report ranges from $80 to over $100, with FICO's portion previously accounting for a modest part of that sum. However, with consecutive annual increases in FICO's fees, mortgage lenders are now shouldering an even heavier burden. The industry's frustration is palpable, as these costs inevitably make their way down the line to consumers.The dominance of FICO (and the lack of alternatives)One reason for the industry's outrage is FICO's near-monopoly on credit scoring in the mortgage space. This has allowed FICO to set its prices with little regard for market pushback, leaving mortgage lenders and borrowers at its mercy.Greg Sher, Managing Director at NFM Lending, underscored this frustration: \"They have a monopoly because there is no competition in the space. So there is no end in sight because we're already now at 500% increases, and it looks like they're just getting started,\" Sher said in reference to the consecutive fee hikes.Jim Wehmann, FICO's executive vice president, has defended the increase, claiming that FICO's fees only constitute a small portion of credit report and closing costs. That means little to industry leaders, however, who see this as yet another example of a \"take-it-or-leave-it\" approach where lenders and consumers lose.Rising fees 'directly impact affordability'The outcry from the mortgage sector is not solely about the price increase but also about the broader implications for competition and affordability. \"In my 22 years in this business, I've never seen such a rapid rise in credit report costs,\" said Josh Harmatz, EVP of Mortgage Production at Goodleap. \"It's disappointing to see this shift, which directly impacts affordability for our customers. As an industry, we should be focused on leveraging technology to reduce costs and barriers, not increasing them to accommodate profit margins for credit reporting agencies.\"The backlash is particularly fierce because such \"junk fees\" are likely to be passed on to borrowers, making mortgages less affordable and pushing homeownership further out of reach.Some see profit-driven incentives at play. Sher noted that FICO's CEO took home far more than his base salary last year, likely due to bonuses. \"What do you think he gets bonused on? It's not losses, it's profitability. And so that train is going to keep going down the tracks, and we need to call it like we see it.\"Competition is keyThe latest price increase has reignited discussions around the need for faster adoption of alternative scoring models that could foster competition and encourage innovation — reducing FICO's hold on the industry.The underlying message from lenders is clear: It's time for regulatory bodies to step up and create an environment where competition can thrive.