A

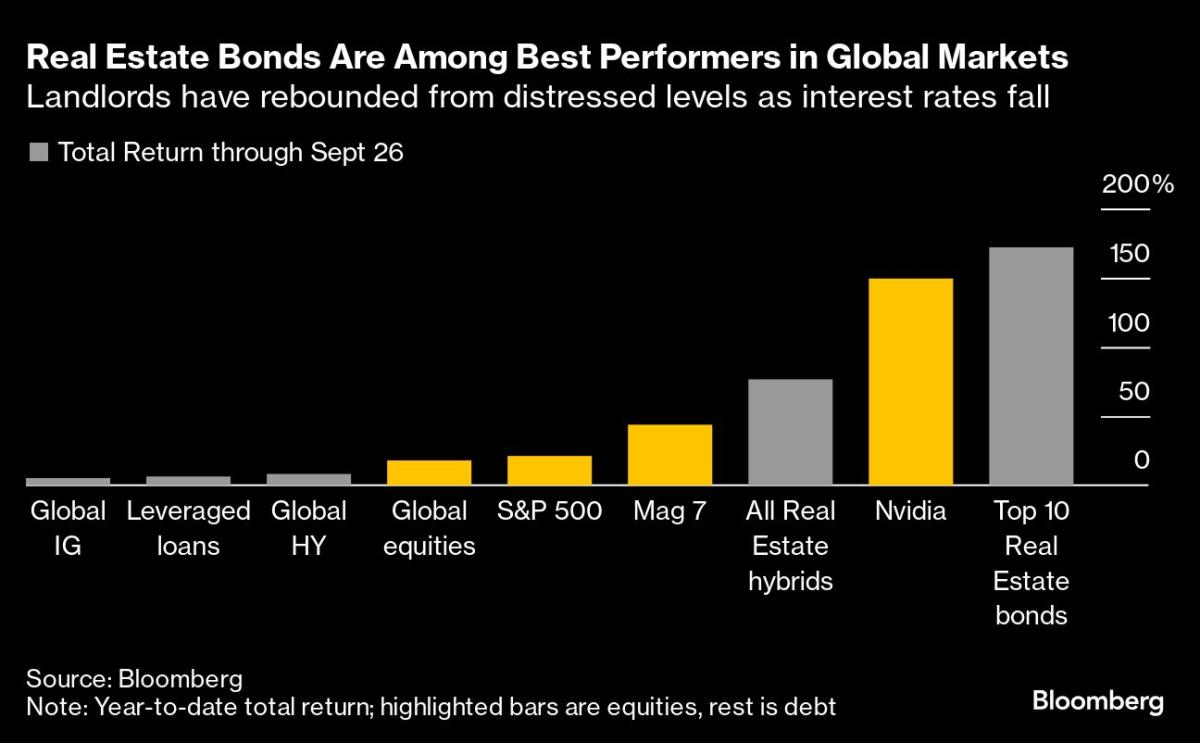

previously beleaguered corner of the debt world has become the biggest winning trade in global financial markets, yielding returns that few traders have seen in over a decade. Hybrids, the riskiest slice of real estate companies' debt, have returned more than 75% this year, with top performers seeing returns of around 170%. This swift turnaround is a surprise given the struggles landlords faced due to higher interest rates and changing work habits following the Covid-19 pandemic.

Real estate debt is now benefiting from major central banks cutting borrowing costs as they pivot towards prioritizing economic growth over battling inflation. "I cannot recall something similar in my career," said Andrea Seminara, CEO of Redhedge Asset Management. "The magnitude of the gains is unprecedented."

Landlords' subordinated bonds had plummeted nearly 50% after central banks increased rates in 2022, making it difficult for companies to refinance old debt. However, as capital flowed into the credit market and interest rates began to fall, companies were able to issue new debt and refinance their existing bonds.

Andreas Meyer, founder of Fountain Square Asset Management, noted that these bonds were "punished due to technical factors." Buying at depressed levels was a bet that companies would be able to replace debt coming due and that falling inflation would allow central banks to cut interest rates. Both proved correct.

The main risk now is that there is little juice left in the trade, with strategists warning that valuations are nearing full. However, buyers and sellers are becoming more confident that the commercial real estate market is bottoming out, and many want to start putting capital to work as the interest rate pain eases.

China has disclosed a series of stimulus measures designed to boost flagging growth in the nation, including lowering borrowing costs on mortgages and easing down-payment requirements for second home purchases. The unusual pace and intensity of these announcements signaled a sense of urgency in Beijing to put growth back on track.

US companies and Asian issuers have stormed debt markets following the Federal Reserve's decision to lower its benchmark interest rate by half-a-percentage-point, with a resurgence in mergers and acquisitions dealmaking turbocharging the US high-grade bond market. Banks and other lenders are lining up more than €10 billion of debt to back a buyout of Sanofi SA's consumer health division.

Blue Owl Capital led the $3.2 billion private debt financing supporting Blackstone Inc. and Vista Equity Partners' buyout of software firm Smartsheet Inc., with 20 other lenders participating. Citigroup Inc. and Apollo Global Management are teaming up in the fast-growing private credit market, agreeing to work together on $25 billion worth of deals over the next five years.

Country Garden Holdings Co. has won bondholders' approval to push back payments on its nine yuan bonds by six months, giving the developer more time to map out an onshore debt overhaul. Credit Agricole SA is looking to raise capital with a bond that has to be repaid after only a decade, adding to a recent raft of longer-duration instruments as investors look to take advantage of the Federal Reserve's rate cuts.

Altice France has held talks with funds including Apollo Global Management about raising new debt to repay looming maturities, a move that would potentially hurt existing creditors. A group of banks led by Bank of America Corp. sweetened terms on a leveraged loan offering to help finance Platinum Equity's acquisition of GSM Outdoors as the deal struggled to attract demand from investors.

Dish Network Corp. is close to striking a deal with some of its convertible bondholders that would give the company new financing and help it extend its debt maturities. Hooters of America is huddling with lenders and advisers amid revenue declines that pushed the restaurant chain to shutter several of its locations.