T

he notion that corporations are buying up all the homes and driving prices to new heights has sparked concern among many, particularly young people priced out of the market. A comment on our previous episode highlighted this issue, suggesting a ban on corporate ownership of residential housing as a solution.

However, the reality is more nuanced. According to data from the PEW Trust and Corelogic, corporate investors were responsible for only 3% of American home purchases in 2021. While it's true that investment companies like Blackstone have significant capital invested in real estate, this doesn't necessarily translate to corporations buying up homes.

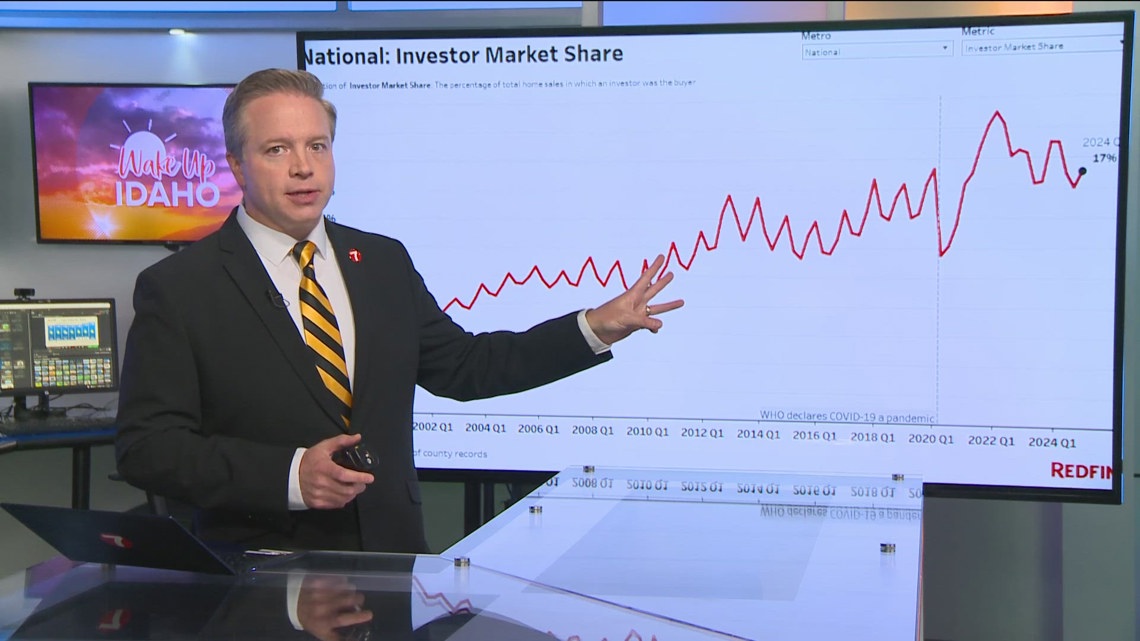

In Idaho, where this trend was particularly pronounced, 26% of homes sold to investors, not necessarily corporations. However, a recent analysis by Redfin shows that investor activity has slowed down significantly since the pandemic. In 2022, investors bought 17% of U.S. homes, down from 24% in 2021 and roughly where it was pre-pandemic.

While investors are buying fewer high-priced and mid-priced homes, they're still snapping up low-priced ones at a rate of about 1-in-4. This is concerning, as these homes could be more affordable for lower-income buyers. However, it's essential to note that most of these purchases aren't made by corporations but rather individual investors looking to make a profit.

In conclusion, while corporate investors are not buying up all the homes and driving prices through the roof, they are still active in the market, particularly when it comes to low-priced properties.