O

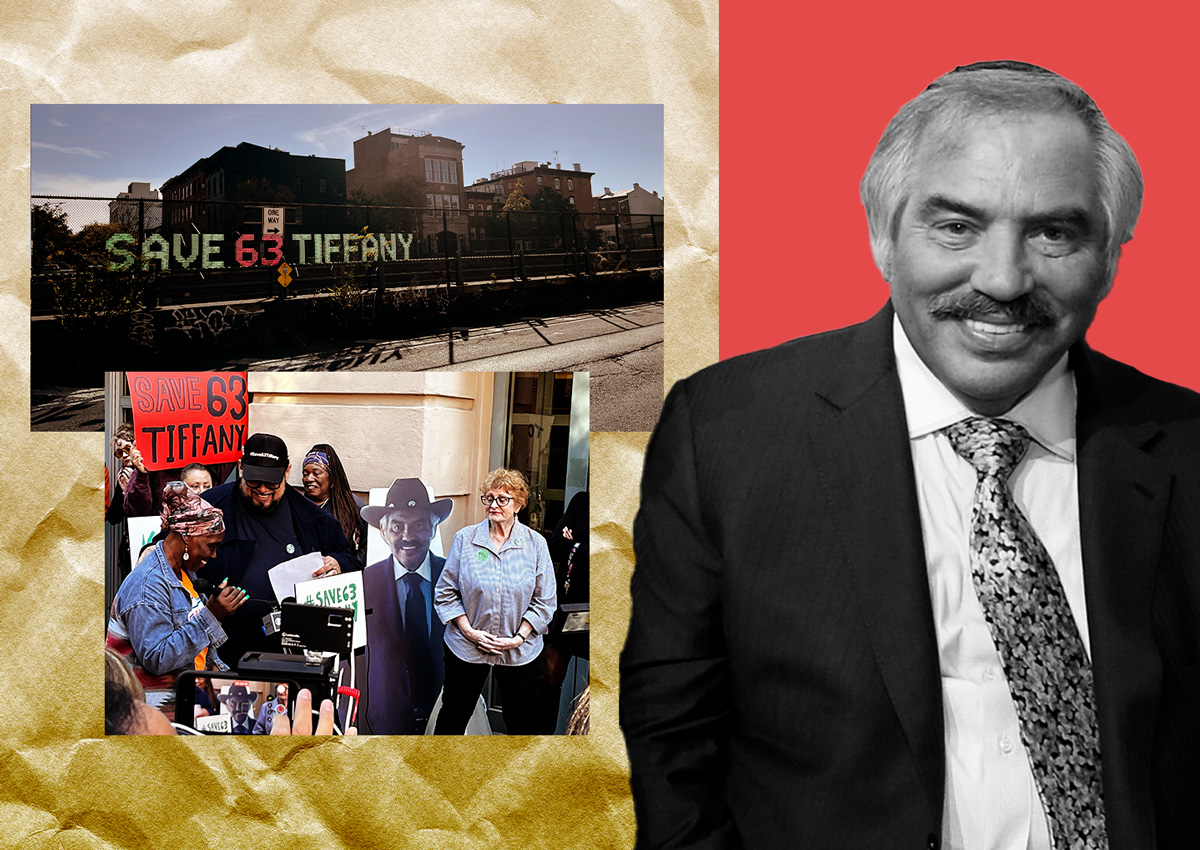

n Halloween morning, tenants of 63 Tiffany Place gathered outside their Carroll Gardens apartment building to demand that landlord Irving Langer sell them the property. The rally was a last-ditch effort to prevent Langer from selling and raising rents when the low-income housing tax credit expires in 2025. A nonprofit had agreed to buy the building and keep units affordable, but Langer's silence left tenants with no leverage.

The Tenant Opportunity to Purchase Act (TOPA) could have changed this scenario. The bill would give tenants a first shot at buying their building if the landlord wants to sell. It would also pause sales for several months to allow tenants to explore financing options and form a cooperative. However, in practice, TOPA often serves as a negotiating chip, allowing tenants to waive their right of first refusal or assign it to a nonprofit.

Assembly member Marcela Mitaynes, who sponsored the bill, claims that plans for Tiffany Place would raise rents and push out tenants if Langer sells. Housing Justice For All's Cea Weaver notes that TOPA has support in Albany but is unlikely to pass before 2025. If it doesn't, Langer can sell, and the new owner can raise rents to market rate.

The Good Cause Eviction bill could offer some protection for tenants when the LIHTC expires. It would cap rent hikes at 10% or inflation plus 5%, whichever is lower. However, this protection only applies to non-regulated units, leaving those in government-regulated buildings vulnerable to large rent increases.