I

n Illinois, seniors with modest means can breathe a sigh of relief thanks to the Senior Citizen Real Estate Tax Deferral Program. This state-sponsored initiative allows eligible homeowners to put off paying part or all of their property taxes on their primary residence. The program's cap is 80% of the home's equity value, up to $7,500, including interest and fees.

Think of it as a loan against your property's market value. You're essentially borrowing from the state, which pays the tax bill upfront. A 3% simple interest rate applies annually, and a lien is filed on the property. The deferred taxes won't come due until one of three events: the home is sold, you no longer qualify for the program, or you pass away.

To qualify, you must meet these criteria by June 1, 2025:

* Be at least 65 years old

* Have a total household income of $65,000 or less

* Not have any outstanding property taxes or special assessments on your home

* Carry insurance against fire or casualty loss

* Have owned and lived in the property for three consecutive years

* Ensure your property is not generating rental income

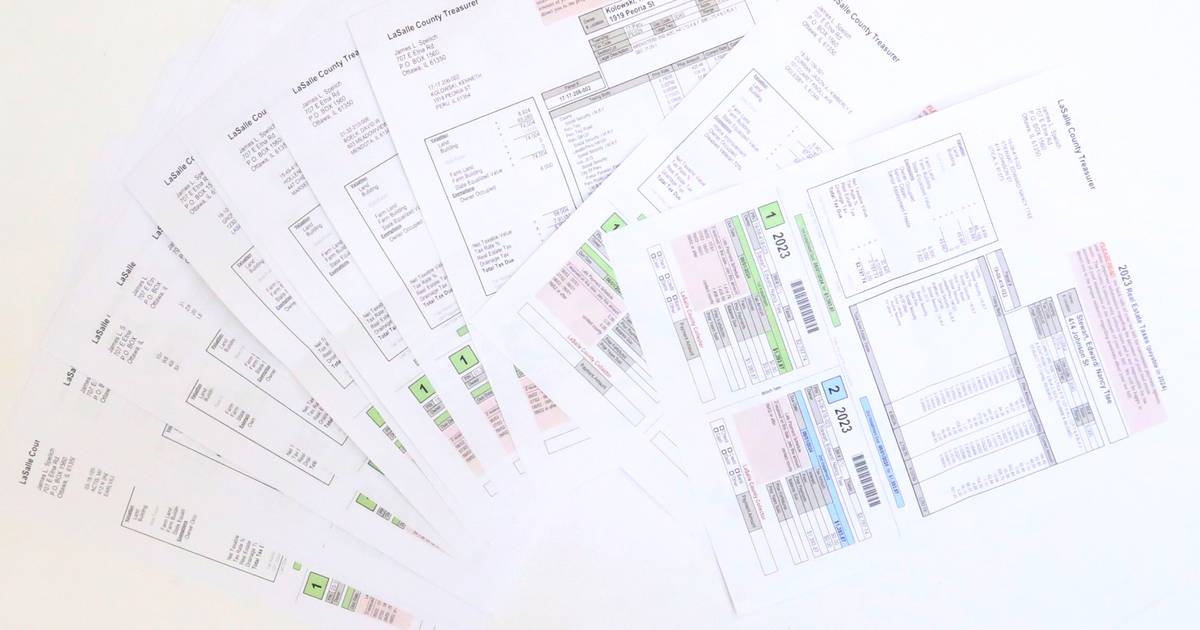

Don't miss the filing deadline: Friday, February 28. For more information and to obtain an application, visit the La Salle County Treasurer's Office or call (815) 434-8219, option 4.