K

ey Takeaways

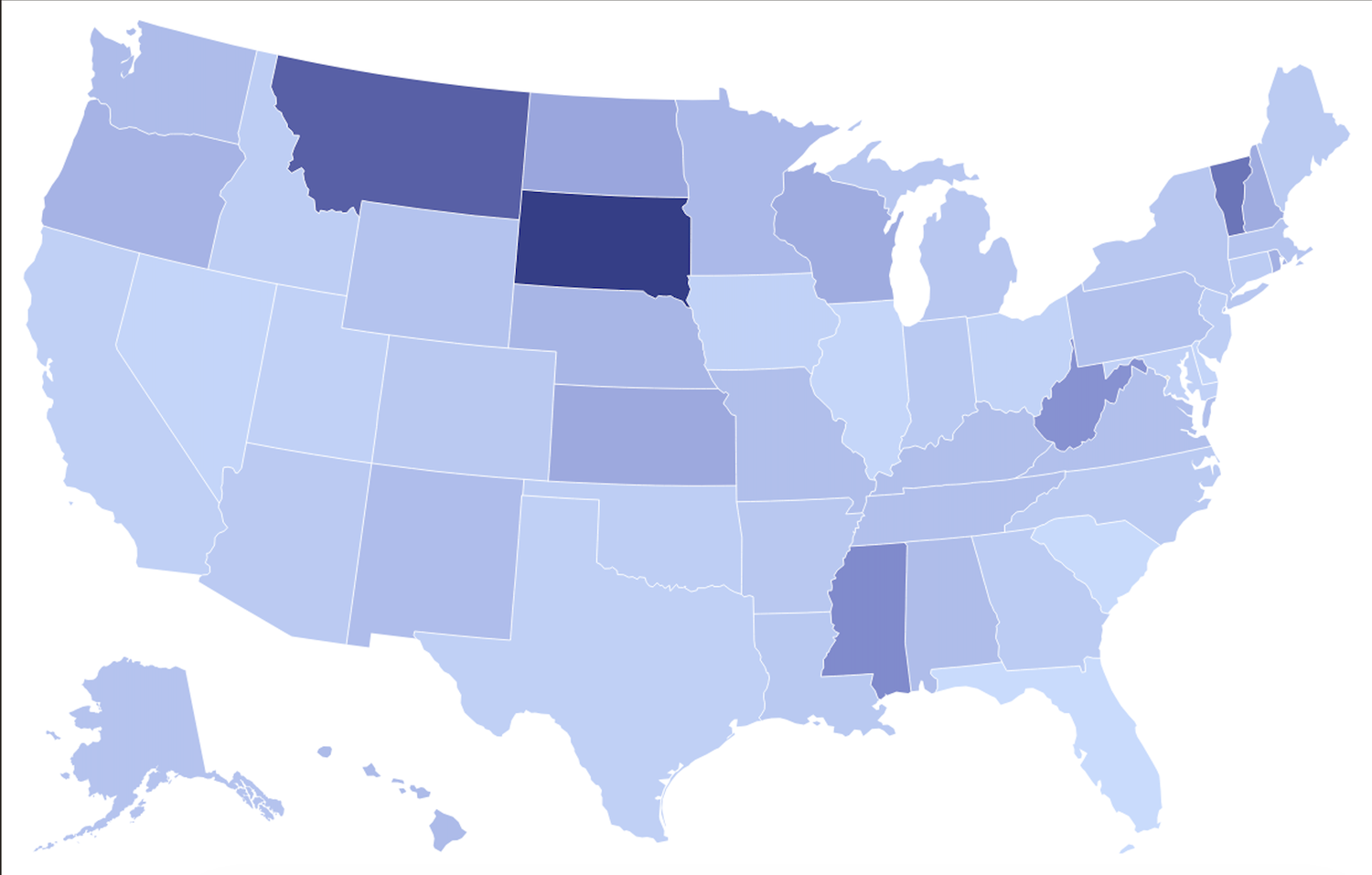

Foreclosure activity—default notices, auctions, and repossessions—has surged 19‑20% year‑over‑year in October, yet remains below historic peaks, per ATTOM data. Florida tops the list, with a 70% jump; South Carolina follows at 68%, Illinois up 33%, and Delaware at 25%. Colorado and Alaska also saw sharp increases of 145% and 127%, respectively.

Impact on Homebuyers

Higher foreclosure rates expand the supply of homes for sale and can depress prices, offering buyers a glimpse into the market’s overall health. The uptick reflects broader affordability pressures, rising borrowing costs, and financial strain across the country.

State‑by‑State Snapshot

- Florida: 70% YoY rise

- South Carolina: 68% YoY rise

- Illinois: 33% YoY rise

- Delaware: 25% YoY rise

- Colorado: 145% YoY rise

- Alaska: 127% YoY rise

ATTOM CEO Rob Barber noted, “Foreclosure activity has climbed for eight consecutive months, signaling a gradual normalization as market conditions adjust and homeowners grapple with higher costs.”

City‑Level Highlights

Tampa leads nationally, with one foreclosure per 1,373 homes—a temporary spike due to backlog updates. Jacksonville, Orlando, Riverside, and Cleveland follow. Conversely, Milwaukee, Indianapolis, Louisville, Washington, D.C., and Detroit have seen declines.

Market Context

Mortgage rates sit at 6.24% (Freddie Mac), barely easing after two Fed cuts. The median price of existing‑home sales in September was $440,387 (Redfin), keeping the market sluggish and sales near historic lows.

For news tips, email [email protected]