W

hitestone has failed to create value since MCB withdrew its $15 per share proposal last year. MCB urges shareholders to demand board engagement with MCB or a alternatives process commits to voting against Whitestone board.

MCB Real Estate issued an open letter to Whitestone REIT shareholders. As shareholder (4.69 M shares, 9.2% of common stock), MCB proposes to acquire all shares for $15.20 per share cash, financing contingency. If no engagement, MCB will vote against entire board at next annual meeting.

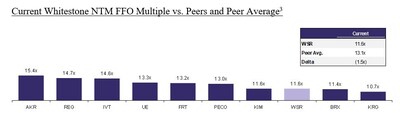

The $15.20 offer delivers a 21% premium to current price and a 25% premium to 30‑day VWAP (Nov 3 2025). Backed by equity, debt, Wells Fargo, proposal values Whitestone at 14.0x NTM FFO, highest strip‑center multiple under $2 B.