T

he antitrust lawsuit against major brokerages and the National Association of Realtors (NAR) has had a lasting impact on the real estate industry. The $418 million settlement, which aimed to reduce commission rates by removing blanket offers of compensation to buyer brokers, has shown little effect nearly a year after its implementation.

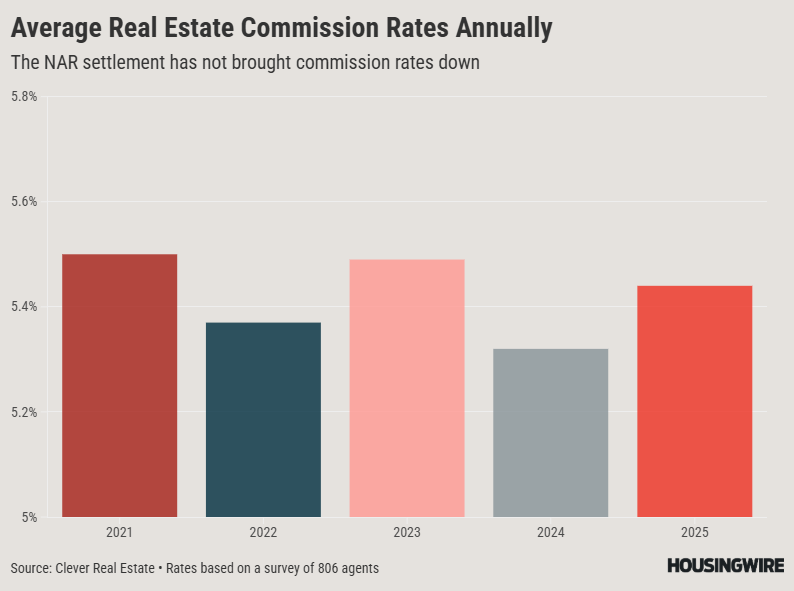

A recent survey from Clever Real Estate found that the average commission rate is around 5.44%, with the listing agent receiving 2.77% and the buyer's agent getting 2.67%. This translates to approximately $20,000 split between the two agents for a median-priced home transaction.

Contrary to expectations, the commission rate has actually increased since the settlement took effect in August 2024, rising from 5.32% in 2024. The current rate is lower than those seen in 2023 (5.49%) and 2021 (5.5%), but still indicates a lack of significant reduction.

Other studies have also reported similar findings. A HousingWire survey found that nearly 60% of respondents saw no change in commission rates, while over 40% of agents experienced pushback from clients about commission rates. Research by the Federal Reserve and Anywhere Real Estate has also suggested that the settlement's requirements may not be having a substantial impact on reducing commission rates.