N

ew York City's industrial market experienced a surge in activity last year, with leasing volumes reaching their highest level since the onset of the pandemic. However, signs indicate that the market is nearing its limits. According to JLL data, tenants leased over 2.8 million square feet in the city's outer boroughs, making it the second-busiest year on record after 2020.

A notable trend was the increased interest in spaces between 50,000 and 100,000 square feet, with 18 leases of that size last year compared to just four in the previous period. However, a slowdown in leasing activity is evident, with CBRE reporting a 36.8% decrease in leases from October to December compared to the two-year average.

The average asking rent jumped to $30.39 per square foot in the fourth quarter, driven by intense competition for limited space among tenants like film production studios and logistics providers. Despite developers delivering 2.7 million square feet last year, the vacancy rate remained at a relatively low 4.3%, according to JLL. With only five significant projects in the pipeline, space is likely to remain scarce, benefiting investors and landlords but hindering prospective tenants.

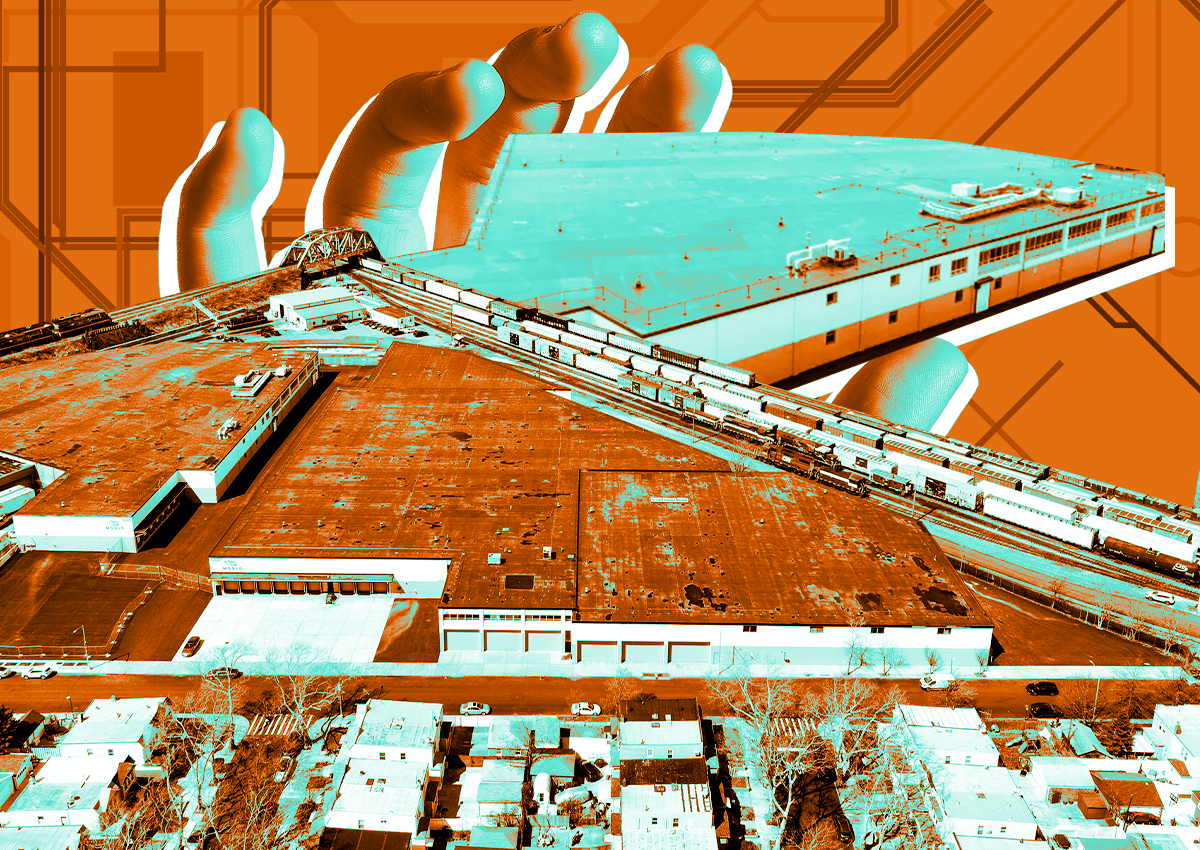

The acquisition of a Greenpoint waterfront site by Prologis for $122 million may signal another major industrial development on the horizon, potentially adding to the already tight market conditions.