T

he Tariff Tornado: A Perfect Storm of Economic Uncertainty

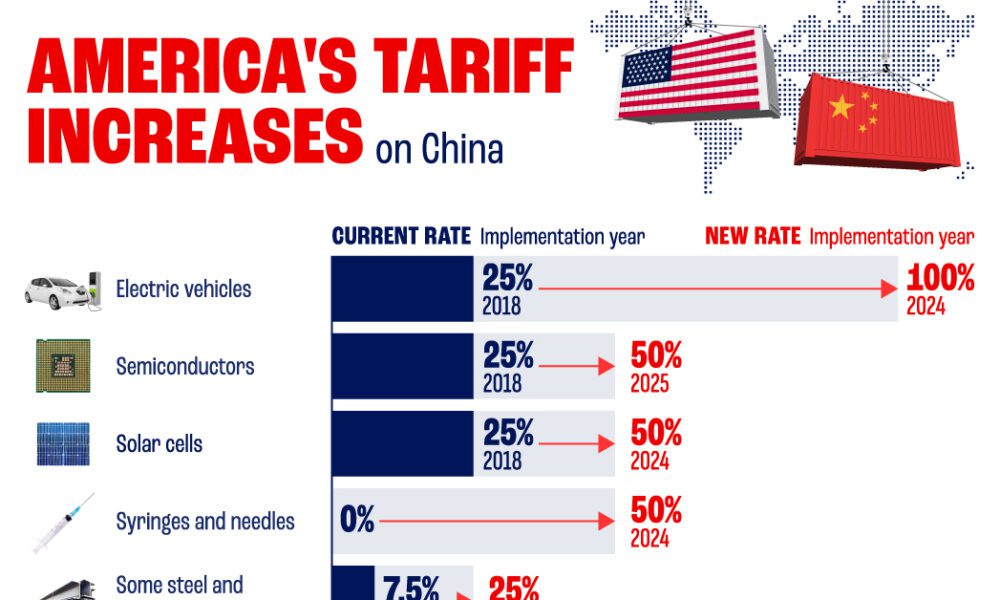

As the world watches in awe, President Trump's tariffs have unleashed a maelstrom on global markets, leaving a trail of devastation in their wake. The ripple effects are being felt far and wide, with prices skyrocketing across the board as businesses scramble to adjust to the new reality.

The stock market is taking a beating, with the Dow plummeting 2,231 points and the S&P down by 322.44. It's been a wild ride, and investors are left wondering if this is indeed the "no pain, no gain" scenario that Trump has promised. But for many Americans, the reality is far from rosy.

The tariffs are having a disproportionate impact on those who can least afford it – low- and middle-income families who will bear the brunt of increased prices. The irony is not lost on many: these same voters supported Trump's policies, only to find themselves caught in the crossfire.

Meanwhile, autoworkers and Republican strategists are touting the benefits of tariffs, citing job creation and economic growth. But history has shown us that this is a short-sighted approach. It takes years for businesses to build the necessary infrastructure to support new jobs, and even then, the benefits are often fleeting.

The real issue at play is the massive disparity in labor costs between the US and other countries like China. With wages averaging $30 per hour in the US compared to just $7 per hour in China, it's no wonder that consumers are facing higher prices and corporations are raking in the profits.

But what about the long-term effects of these tariffs? Will they have a lasting impact on our real estate industry? The answer is yes. As the stock market continues its downward spiral, consumer confidence will take a hit, leading to decreased demand for homes and commercial properties. Inventory will grow, and negotiations on higher-end properties will become more challenging.

The writing is on the wall: tariffs are not the solution to our economic woes. Instead of creating jobs and stimulating growth, they will only serve to increase costs and reduce consumer spending power. It's time to rethink our approach and explore alternative solutions that benefit all Americans – not just corporations and special interests.