A

s a former editor for The Real Deal, I often sidestepped congestion pricing stories from 2007 to 2019. Despite opponents' claims that it would harm property values by deterring visitors, I expected modest gains due to faster commutes and mass-transit upgrades funded by congestion fees. The Real Estate Board of New York supported the plan, which was approved in 2019.

Since congestion pricing began on January 5, data shows no negative effects on real estate and some positive signs. Traffic and delays are down, pedestrian counts and subway ridership are up, and other measures indicate increased activity in the "congestion relief zone." For example, Broadway show attendance has risen. While it's hard to quantify congestion pricing's impact, the predicted catastrophe hasn't occurred.

Gridlock was bad for business, including real estate, which is why REBNY and other groups supported cordon tolling. Parking garage owners opposed it due to obvious reasons, but most vocal critics were people who dislike change, especially fees for something that had been free. Their objections were philosophical, not evidence-based, so the results won't likely sway them.

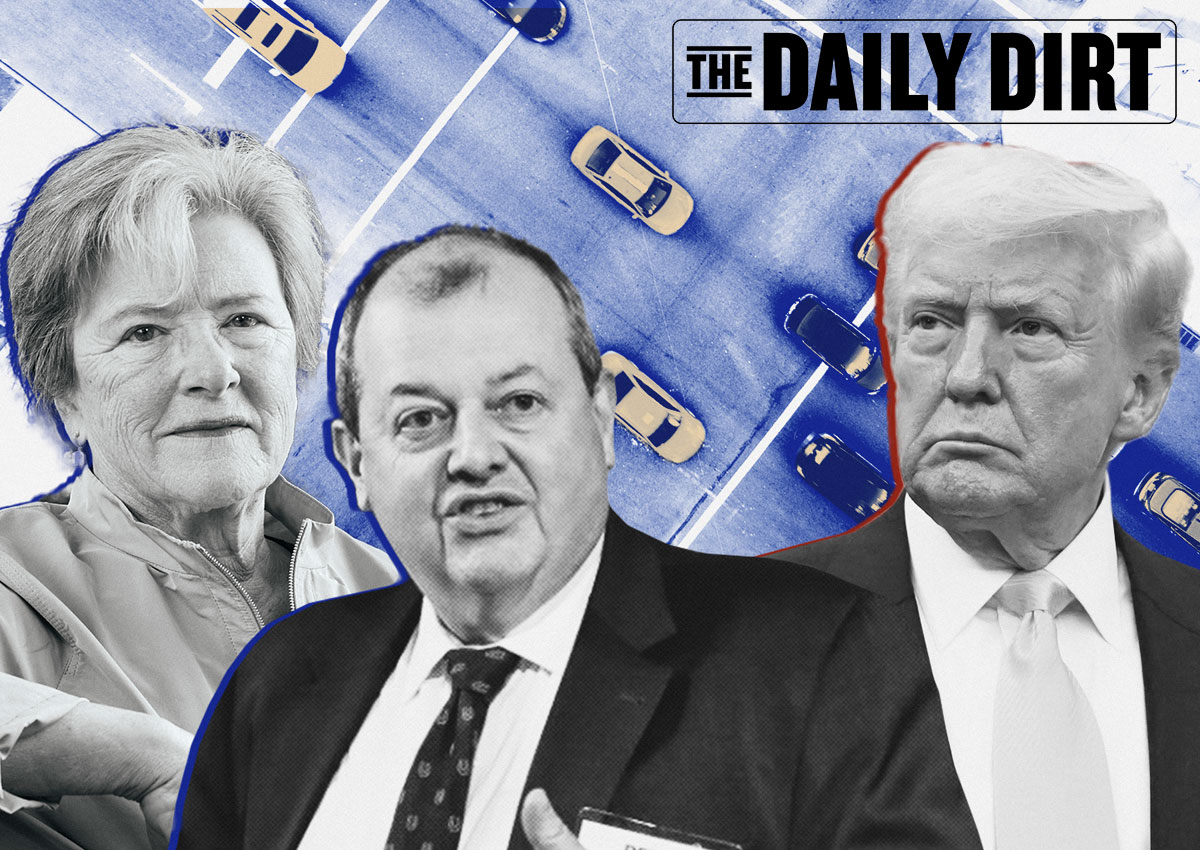

The New York Post reported gains in subway use but called it "crowding." President Trump's attempt to rescind federal approval is being challenged by the MTA. Regardless of the outcome, we have eight weeks' worth of data to evaluate claims on both sides.