S

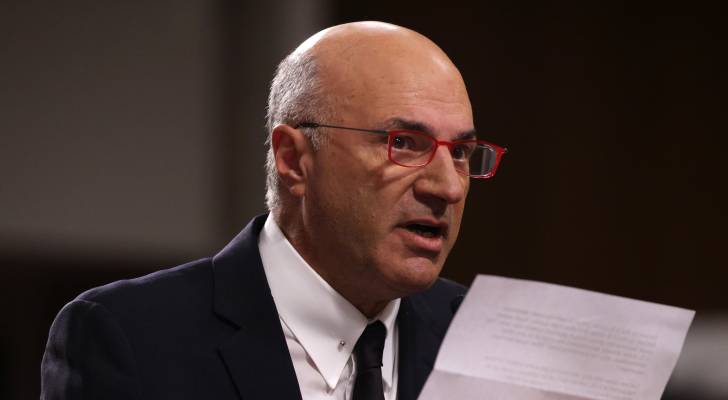

hopping for a home in America has become increasingly challenging, and according to Kevin O'Leary, it's unlikely to get easier anytime soon. In an op-ed for the Daily Mail, he highlighted a "crushing indicator" for the US housing market: inflation data. The recent surge in consumer prices, particularly core CPI (3.1% year-over-year) and producer price index (0.9% month-over-month), is a red flag. O'Leary believes this reinforces his long-held warning that Trump's tariffs will eventually be passed on to consumers.

Inflation can indirectly impact real estate through central bank policy, making it less likely for the Federal Reserve to cut interest rates at its upcoming September meeting. In fact, O'Leary predicts there won't be a rate cut in 2025, which would keep the US housing market stagnant. Elevated interest rates not only make mortgages more expensive but also choke supply by limiting existing homeowners from selling their homes and taking on new, higher mortgages.

The average 30-year fixed mortgage rate is currently 6.58%, making it difficult for many homeowners to sell their properties and take on a new mortgage with a higher interest rate. As a result, they're demanding high sales prices, leaving buyers feeling hopeless with exorbitant listings and high-interest mortgages. O'Leary bluntly states that the days of "free money" and low mortgage rates are over due to America's economy firing on all cylinders, driven by Trump's industrial policy forcing companies to invest in the country.