T

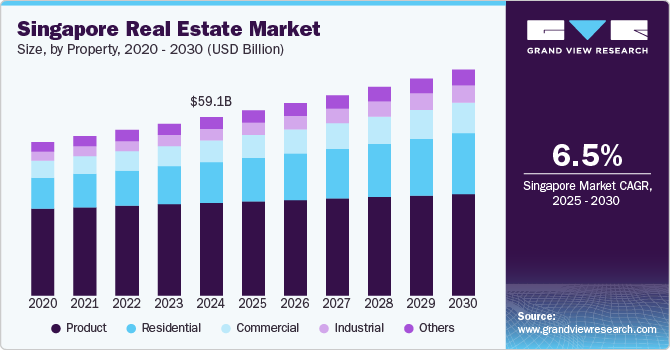

he Singapore real estate market size was valued at USD 59.08 billion in 2024, with a projected compound annual growth rate (CAGR) of 6.5% from 2025 to 2030. The market's growth is driven by affordable housing initiatives, industrial demand, and office space evolution. The government's focus on affordability has led to a high homeownership rate, exceeding 80%, making Singapore one of the most homeowner-friendly countries globally.

Affordable housing projects in Singapore have significantly impacted the real estate market by enhancing accessibility and promoting homeownership among lower- and middle-income families. However, these initiatives also contribute to rising prices in both public and private housing markets. The government actively manages this dynamic through policies aimed at maintaining market stability, such as loan-to-value ratios and restrictions on speculative buying.

The office sector is undergoing transformation, with companies seeking locations outside traditional city centers to attract talent and create less dense work environments. This shift has been accelerated by Singapore's emergence as a technology hub, where large tech firms drive demand for both office spaces and co-working environments. The hospitality sector also plays a crucial role in market growth, bolstered by initiatives like the Singapore Tourism Board's BOOST program.

Singapore's real estate market has demonstrated resilience despite global economic challenges. Private house prices have continued to rise for twelve consecutive quarters, indicating strong demand even amidst rising interest rates and inflation. The government's proactive land sales strategy has further stimulated investment activities, with significant transactions occurring in prime locations.

The transformation of the office sector is significantly driving the real estate market, influenced by evolving work patterns, demographic shifts, and strategic government policies. As companies adapt to hybrid work models, there is a notable shift in demand for office spaces that prioritize flexibility and employee well-being. Organizations are seeking locations outside traditional central business districts to create less dense environments that appeal to talent.

The commercial segment is expected to grow at a CAGR of 6.0% from 2024 to 2030, driven by government policies aimed at enhancing Singapore's attractiveness as a global business hub. The rise of Singapore as a technology and financial services hub further propels demand for commercial properties, particularly office and co-working spaces.

The rental segment dominated the market in 2024, offering significant advantages that appeal to a different demographic. Renting provides flexibility, lower upfront costs, and minimal ongoing responsibilities compared to buying. This flexibility allows renters to adapt quickly to changing circumstances, such as job relocations or shifts in personal plans.

Home purchases in Singapore are expected to grow at a CAGR of 5.9% from 2024 to 2030, driven by the desire for stability and long-term investment. Owning a home allows individuals to build equity over time, benefiting from potential capital appreciation in Singapore's historically strong property market.

The Singapore real estate company landscape is characterized by a mix of prominent domestic players and an influx of foreign investors, creating a moderately competitive environment. Key players include UOL Group Limited, CapitaLand, City Developments Limited, GuocoLand Limited, and the Far East Organization. These companies dominate the residential and commercial sectors, leveraging their extensive experience and resources to capitalize on emerging opportunities in a rapidly evolving market.

The Singapore real estate market is expected to reach USD 62.89 billion in 2025, with a projected CAGR of 6.5% from 2025 to 2030, reaching USD 85.96 billion by 2030. Residential real estate products accounted for a market share of 47.12% in 2024, driven by affordable housing initiatives and the government's promotion of public housing through the Housing Development Board (HDB).