T

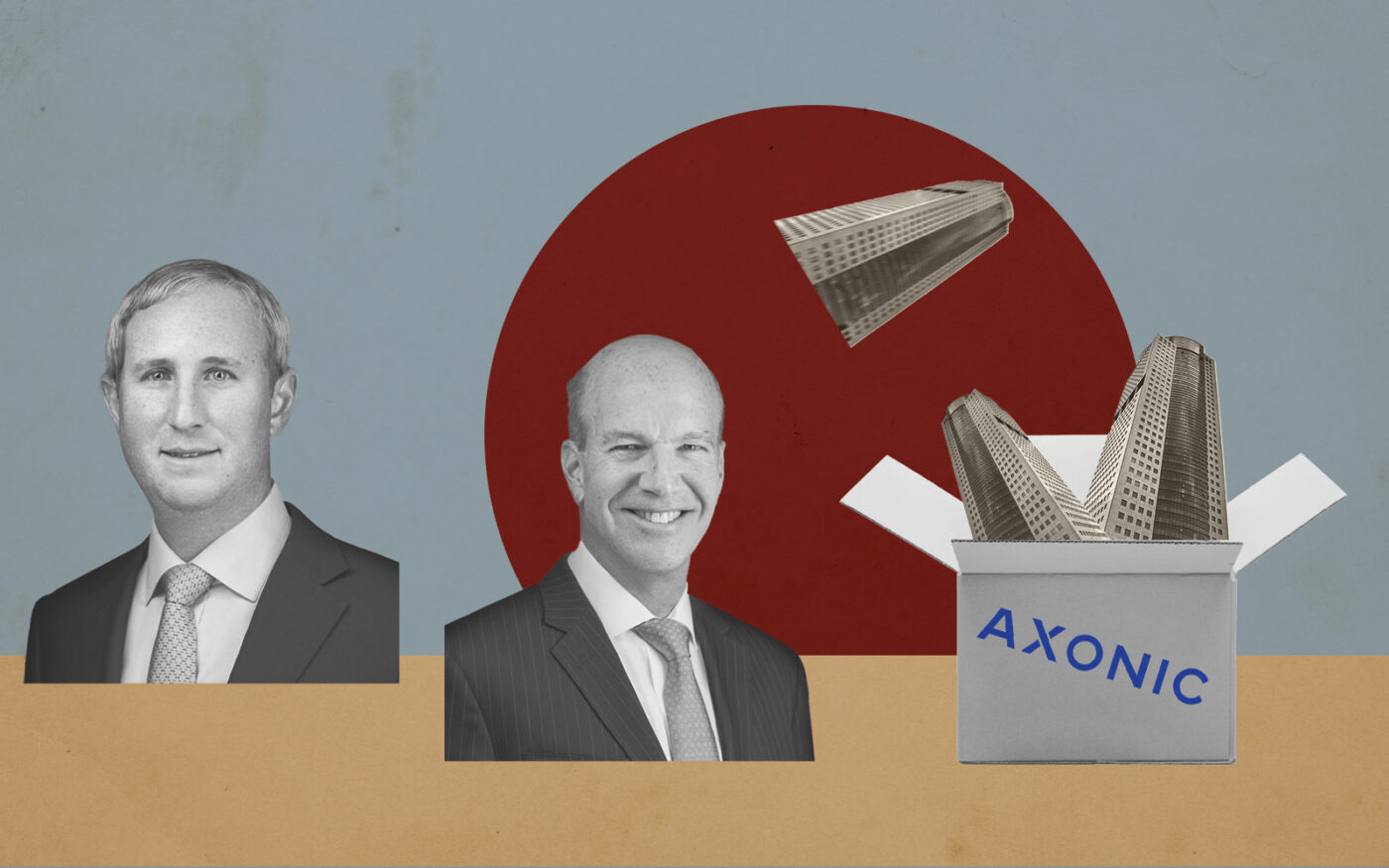

aconic Capital Advisors, a New York-based hedge fund, is reportedly winding down its commercial real estate (CRE) operation and exploring the sale of one of its funds to Axonic Capital. The talks are ongoing but could still fall through. James Jordan, who leads Taconic's CRE unit, will join Axonic as a partner in the first half of next year, bringing some colleagues with him.

Taconic is expected to retain its advisory role and receive a revenue share from the sold fund, which has nearly $200 million in commitments. The firm will also keep three earlier CRE dislocation funds, totaling around $800 million in assets. Taconic's exit from CRE marks a shift towards its core strategies of merger arbitrage and corporate credit.

The hedge fund has invested over $3 billion in direct real estate deals and made more than 175 transactions in the sector. The commercial property market has faced challenges due to high borrowing costs and depressed values, leading to difficulties for borrowers seeking refinancing.