T

DA Investment Group has invested $47 million from pension funds into San Francisco's Chinatown and South of Market neighborhoods. The institutional investor used $17 million to purchase a three-story mixed-use building at 670 Clay Street in Chinatown, securing a "friendly" deed-in-lieu deal with its former owner, Brixton Capital affiliate. TDA also invested $30 million in a commercial mortgage-backed securities loan for an undisclosed project in SoMa.

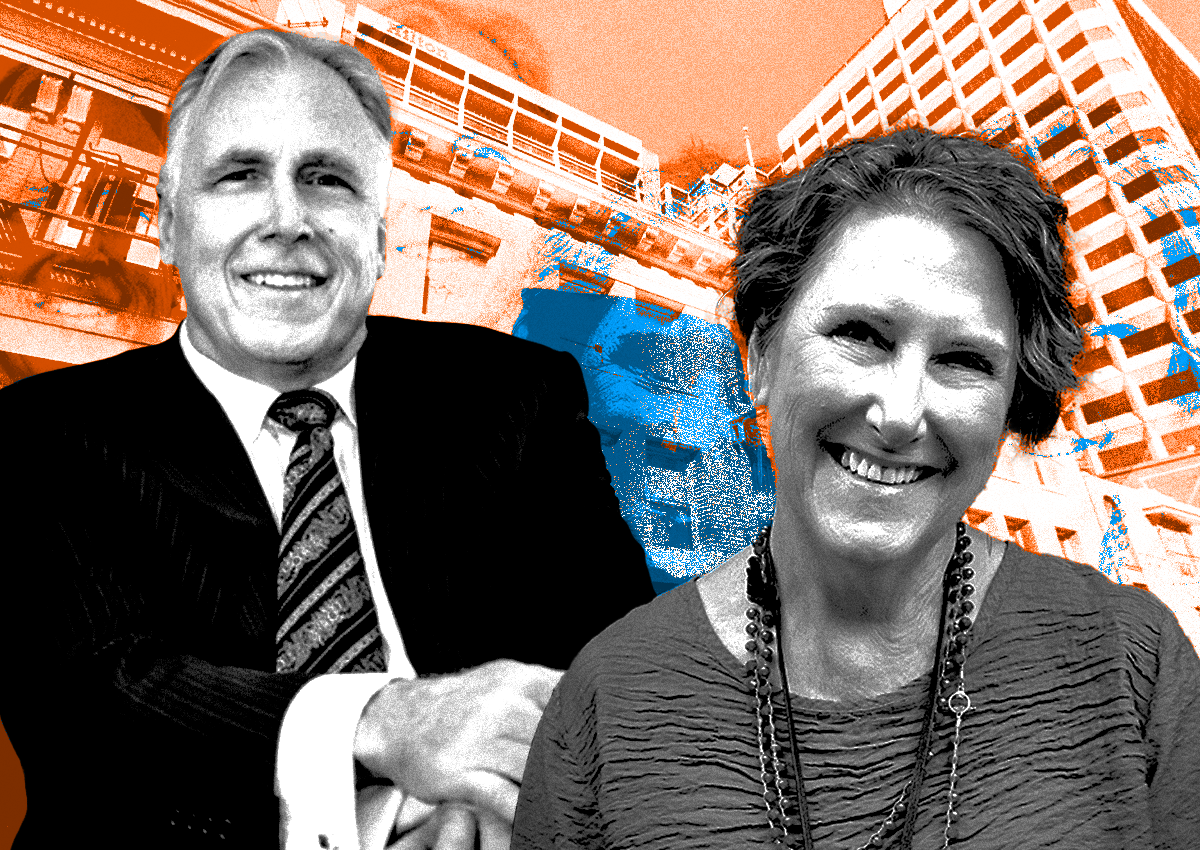

"We take a longer-term perspective," said Paula Purcell, executive vice president and chief development officer for TDA. "Areas like Chinatown still need quality mixed-use real estate offerings." The firm manages pension capital and is investing across the Bay Area, California, and the West Coast. In May, TDA acquired a project to build two five-story buildings at 130 Townsend Street from Presidio Bay Ventures in another deed-in-lieu deal.

TDA sees potential for residential, office, and retail uses at 670 Clay Street, which includes three parcels with 150 single-residence-occupancy units. Brixton was $18.1 million in debt on a loan from TDA when it handed over the deed. TDA has no intention of flipping the property, holding onto some of its 30 nationwide properties for decades.