T

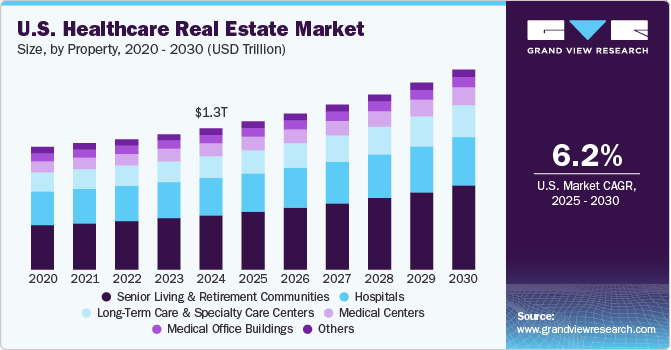

he U.S. healthcare real estate market size is estimated at USD 1,324.52 billion in 2024 and is expected to expand at a CAGR of 6.2% in the forecast period. The industry has experienced significant growth over the past decade due to factors such as an aging population, increasing healthcare spending, expansion of outpatient facilities, digital health solutions, and new technologies.

The U.S. population is experiencing a demographic shift toward an older population, with approximately 62 million adults aged 65 and older residing in the country, accounting for about 18% of the population. This trend is expected to continue, with projections indicating that the number of individuals aged 65 and older will rise from approximately 62 million in 2024 to about 84 million by 2054.

The increasing hospitalization rates, physician shortages, and acute disease prevalence create a robust demand for expanded healthcare infrastructure. The U.S. is projected to have approximately 36.2 million hospitalizations in 2025, with expectations of this number rising to 40.2 million by 2035 due to an aging population.

The senior living and retirement community sector is experiencing significant growth, projected to expand at a CAGR of 7.7% from 2024 to 2030. This demand surge attracts real estate developers and institutional investors, who view senior living as a stable and promising asset class.

Medical Outpatient Buildings (MOBs) are poised to benefit from shifting consumer preferences for more accessible healthcare and broader industry trends. In 2024, MOB vacancy rates declined while asking rents increased, even amid strong new supply. Capital markets activity rebounded, with rising sales and falling cap rates for the first time since mid-2022.

The lease model held a market share of 65.10% in 2024, driven by various practical advantages such as flexibility, scalability, predictability, and long-term nature. The healthcare real estate rental model is anticipated to grow at a CAGR of 6.1% from 2024 to 2030.

Key U.S. healthcare real estate companies include Healthpeak Properties, Inc., Ventas, Inc., Welltower Inc., Omega Healthcare Investors, Inc., and CareTrust REIT, Inc. These companies collectively hold the largest market share and dictate industry trends.

Recent developments in the U.S. healthcare real estate market include Healthpeak Properties' acquisition of King Street Properties' minority interest in their joint ventures involving eight lab buildings in Cambridge and Lexington, Massachusetts. CareTrust REIT, Inc. acquired a skilled nursing portfolio consisting of five facilities with a total of 498 licensed beds located in the Southeastern United States.

The U.S. healthcare real estate market is expected to maintain its growth momentum, reaching an estimated revenue of US$ 2,270,404.3 million by 2030. The market size value in 2025 is USD 1389.42 billion, with a revenue forecast in 2030 of USD 1876.77 billion and a CAGR of 6.2% from 2025 to 2030.

The report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030, segmented by property and model: Hospitals, Medical Office Buildings (MOBs), Senior Living and Retirement Communities, Long-Term Care and Specialty Care Centers, Medical Centers (Life Science, Biotech, Research Centers, etc.), and Others (Retail Health, Health Campuses, etc.).