V

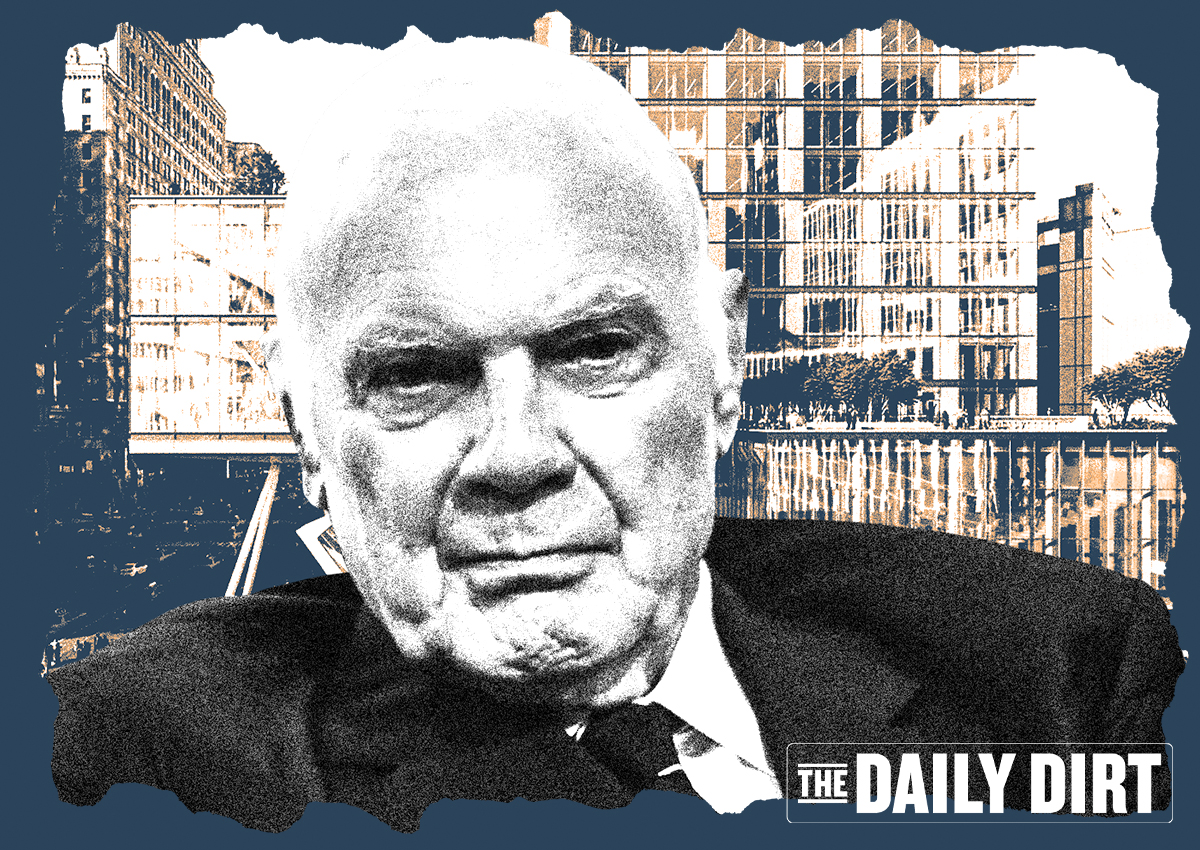

ornado Realty Trust is thriving in a landlord's market, with CEO Steve Roth predicting that the company will lease nearly 3.8 million square feet across its portfolio by year-end, the most since 2014, at an average starting rent of $112 per square foot. This quarter alone, Vornado leased 454,000 square feet across 18 deals in the New York office market at $92 per square foot.

Roth attributed this success to a lack of new office supply on the horizon, with no major new office starts in five years due to high construction costs and capital expenses. "No new supply always begets a landlord's market," he said. Vornado's properties are competing in the smaller Class A office space, where demand is strong and vacancies are rapidly evaporating.

However, not all news is positive for the company. President and CFO Michael Franco acknowledged that Vornado still has a handful of overleveraged assets, which may require refinancing or face reduced investment if debt terms are unfavorable. The company would consider handing over the keys to these properties if necessary.

Roth also highlighted the potential for development at the site of the former Hotel Pennsylvania, which is now "down to grade and ready for development." Vornado has previously considered building an office tower on the site but may now explore alternative uses, such as a platform for events like New York Fashion Week.