US Housing Market Stagnant Despite Record $700 Billion Inventory

Stubborn mortgage rates and Trump policies fuel US housing-market gridlock.

Wealthy Developer Slams Powell Over Housing Market Downturn

Economists urge rate cuts to boost struggling property market

Don't overlook this crucial home buying mistake: a common error, says seasoned real estate expert

Dana Bull shares her expert advice on buying a quality home that's well-maintained and built to last.

Securing a Fair Deal in a Fast-Paced Real Estate Market

Evaluating Offers: Look Beyond the Price to Get the Best Deal.

US Home Sales Hit Record $698B Value, Marking Harsh Market Reality

US housing inventory reaches 5-year high, signaling shift in market dynamics.

Hong Kong's Stock Market Revives, But Property Sector Remains a Concern

Decline in interbank rates may boost real estate, but underlying problems persist.

Tulare County's housing market defies California trend: what's fueling the surge?

California's housing market may be slowing, but the Central Valley is bucking the trend with 3.4% home sales increase.

Aspen Real Estate Market Sizzles as Summer Approaches

Local real estate market trends for summer sales season and how they're influenced by financial markets.

Los Angeles Rams Executive, Mortgage Mogul Among May's Priciest Home Buyers

Two West End homes in a gated community top Richmond's priciest sales last month.

Unlocking Real Estate Success: Bridging Client Fears and Bank Needs

Expert Insights on 2025 Real Estate Trends, Investor Strategies and Balancing Profit with Social Responsibility.

Real estate mogul criticizes Powell for exacerbating housing market woes

Grant Cardone Criticizes Fed Chair Powell's Interest Rate Policies, Says They Hinder Home Buying.

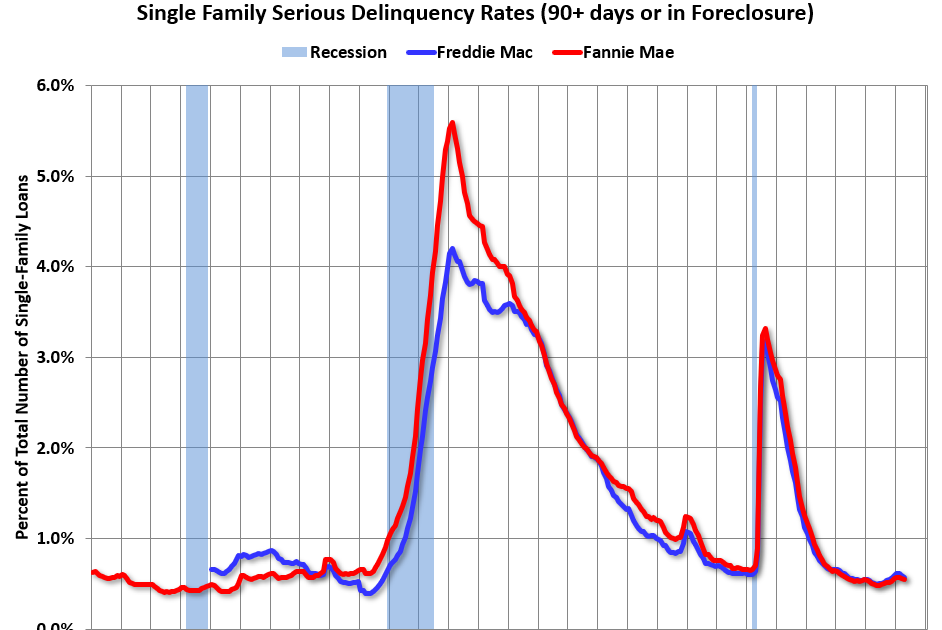

Fannie's Multi-Family Delinquency Rate Hits 12-Year High

Fannie and Freddie: Single Family Serious Delinquency Rates Continue to Decline

Weekly Real Estate Update: Rates Fall, Market Adjusts (June 1-7)

Mortgage rates dip, listings increase: What it means for buyers and sellers this summer.

US Housing Market Shift: Sellers Outnumber Buyers by 500,000

Real estate market dynamics are undergoing significant changes.

China's Real Estate Slump Persists Amid Ongoing Stimulus Measures

Policymakers struggle to revive real estate sector, which has seen stagnant prices since May 2023.

San Jose Downtown Building Defaults on Mixed-Use Loan

Commercial building in downtown San Jose defaults on loan.

RatePlug Launches Integrated Home Search and Financing Solution

Affordable home search, mortgage rates, pre-approval and lead scoring for agents and lenders.

Unlocking the Future's Most Promising Breakthroughs

Real estate poised for boom as rates drop; agents can thrive with tailored, tech-savvy services.

Tech Trends: Compass, Prudent AI and Emerging Innovators

New weekly series explores tech trends and innovations in mortgage and real estate.

Barings Provides $548.5M Refinancing for Multifamily Portfolio

Barings provides $548.5 million loan to refinance nine apartment properties across six states.