I

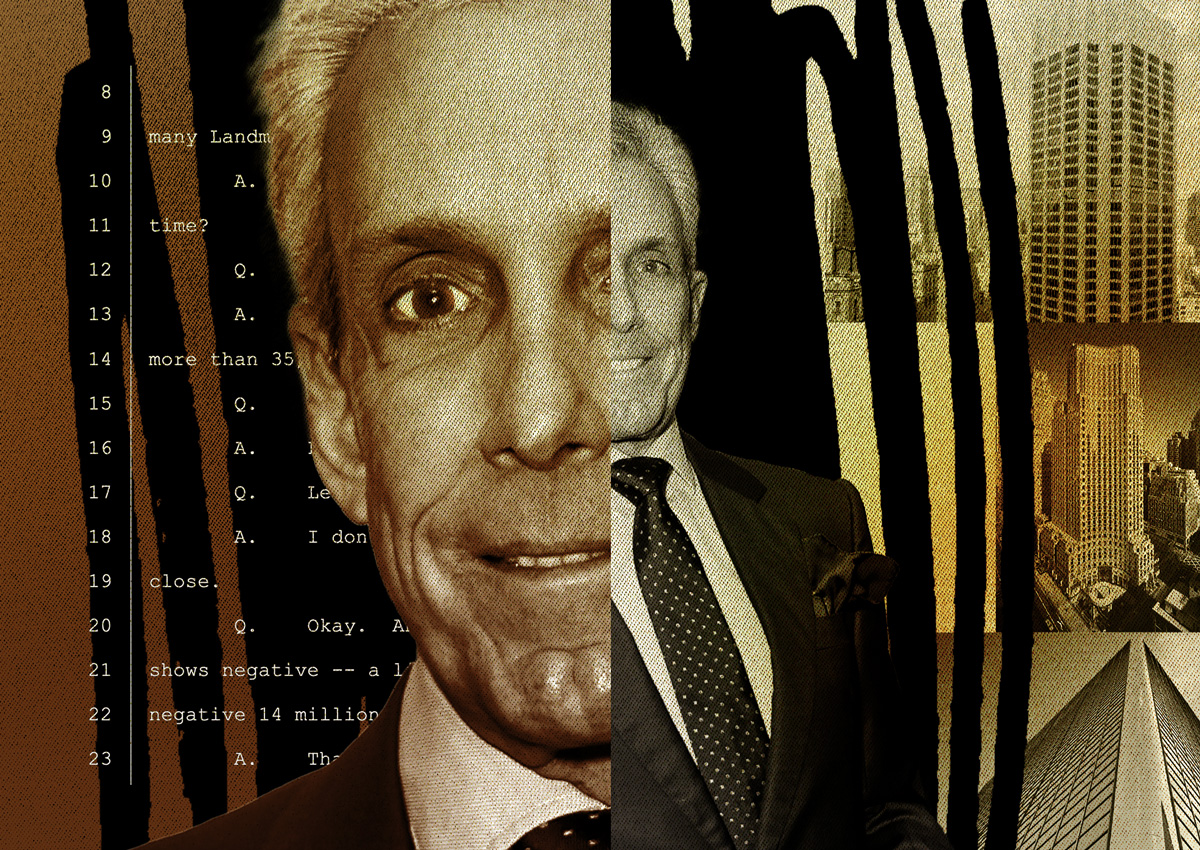

n just 10 days, a court will decide the fate of Charles Cohen's vast fortune. At stake are assets tied to a $534 million loan that Fortress Investment Group claims is in default and a $187 million personal guaranty it can collect on. This would be the largest UCC foreclosure ever, but even if successful, it may not satisfy Cohen's debt. According to court filings, Fortress could then pursue his company, Cohen Realty Enterprises, for payment if it's solvent.

However, there are doubts about the company's financial health. A recent audit found "substantial doubt" about its ability to continue as a going concern due to significant losses and negative equity. Cohen Realty lost $22.5 million in the fourth quarter of 2022 and posted negative equity of $502.5 million.

Cohen confirmed under oath that the collateral for the Fortress debt is struggling, with assets running a collective net loss of $42 million. When questioned about specifics on his business dealings, he faltered several times, sparking concerns about his level of involvement in the company.

Fortress has asked the court to block Cohen from selling or transferring any more interests in his properties, citing allegations that he's hiding assets, including a $20 million mansion and luxury boats. The billionaire may be bracing for the worst: an auction that doesn't cover his personal guaranty.