S

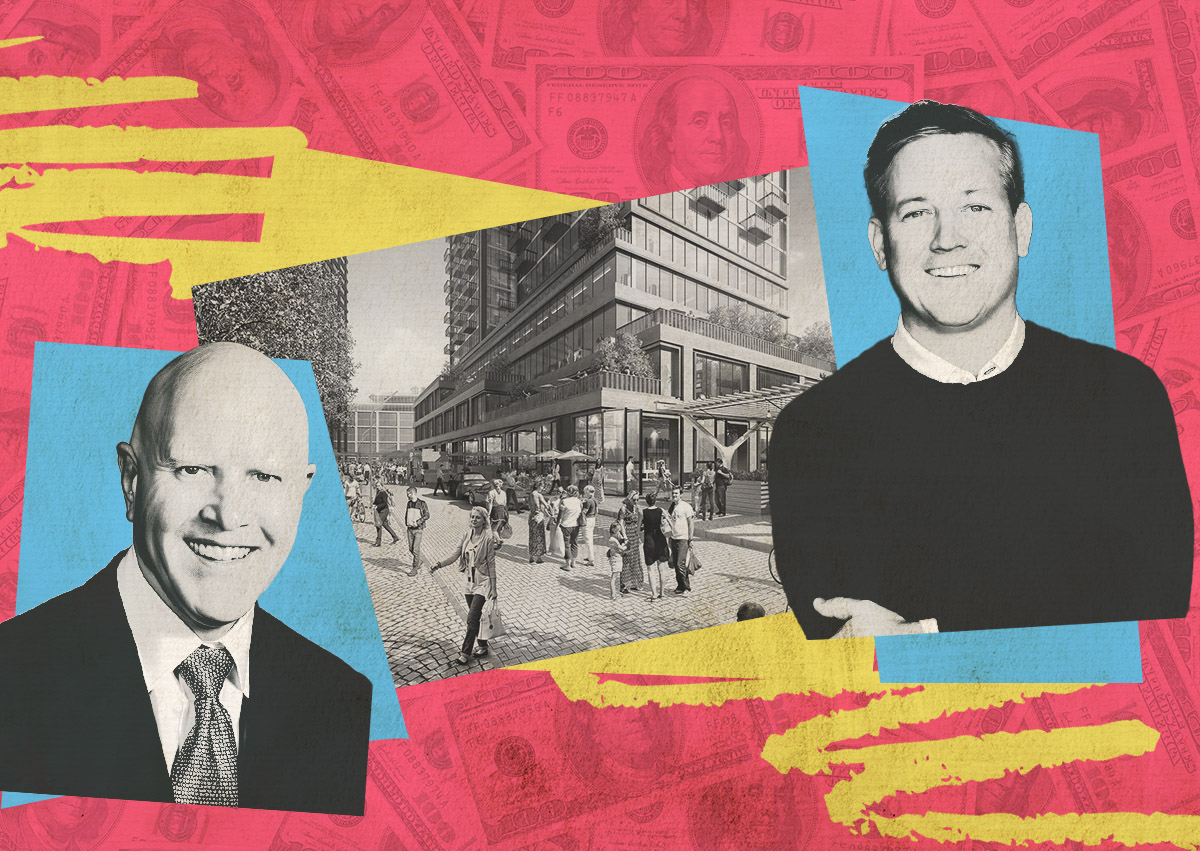

terling Bay's Lincoln Yards initiative is under increased financial scrutiny after a significant write-down on a loan from Bank OZK. The bank recognized a $20.8 million charge-off, reducing the loan balance to $107 million, or 90% of the June 2024 appraised value. This loan, secured in December 2019 and modified six times since then, has been reclassified from "substandard accrual" to "substandard nonaccrual." Bank OZK CEO George Gleason expressed growing impatience with Sterling Bay's slow progress on recapitalization efforts.

Sterling Bay aims to revitalize a 53-acre stretch of land along the Chicago River with a mixed-use hub, but has struggled to maintain momentum. Major backers J.P. Morgan Asset Management and Lone Star Funds are seeking to offload their stakes at significant discounts. Sterling Bay has been actively pursuing new financial partners for over a year, but has encountered setbacks, including a recent rejection from the Chicago Teachers' Pension Fund.

To alleviate financial pressures, Sterling Bay has listed several properties near Lincoln Yards for sale, including a bioscience center. Bank OZK is also taking steps to mitigate its commercial real estate exposure in Chicago, including extending the maturity date of a $150 million loan and deferring the maturity date of a nearly $70 million loan. The bank is discussing potential additional reserves with Sterling Bay, but plans to cap new loans at $500 million as part of a shift toward risk management and diversification.