T

he Federal Reserve's recent rate cuts aim to alleviate pressure on commercial real estate borrowers and lenders. However, the post-pandemic shift in work habits has put office loans under stress, with tens of billions of dollars in potential losses looming for U.S. banks. Experts believe the resilience of the banking system and available capital will help contain the damage.

Approximately $1 trillion of commercial real estate debt is due next year, with nearly 8% tied to the troubled office sector. While rate cuts won't save the office market from a reset, experts think they'll prevent a broader economic downturn. The average CRE loan rate maturing in 2024 is 4.3%, while new loans have an average rate of 6.2%. This means refinancing will be challenging for many borrowers.

The Fed's rate cuts lower the risk that debt holders won't afford refinancing, and experts expect future cuts to nudge the 10-year yield down to the mid-three percent range. This would make refinancing more feasible for many deals. The pivot to rate cuts also sends a message to CRE investors about the possibility of an economic "soft landing."

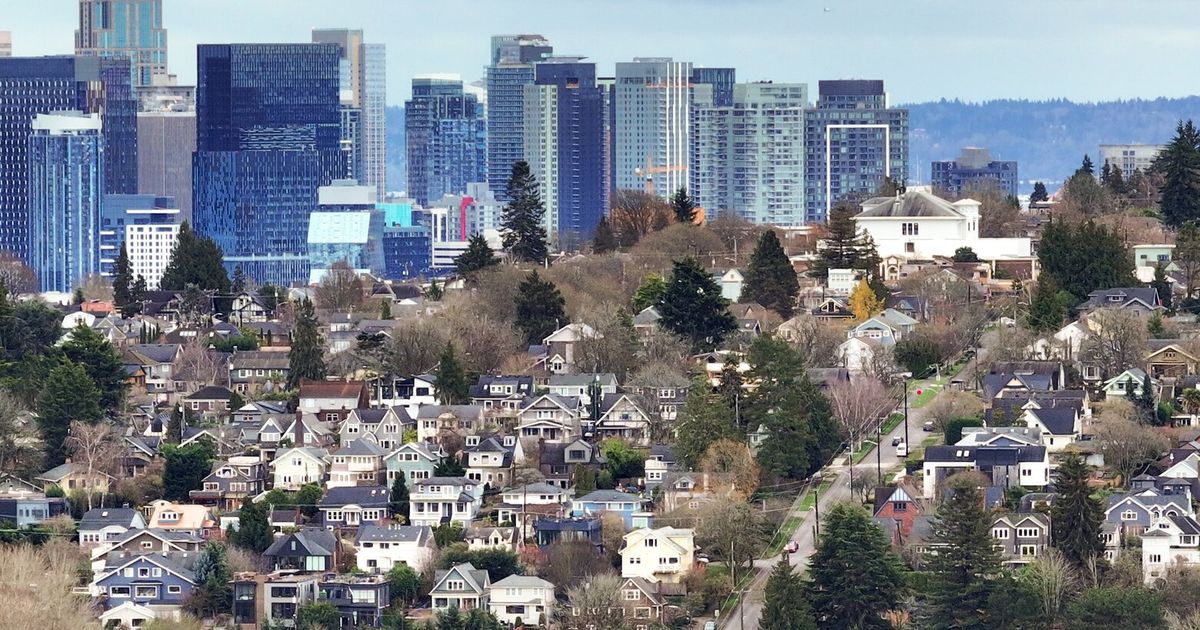

Office properties face significant issues due to the shift to work-from-home, with average lease sizes 27% smaller than pre-pandemic levels and nearly a fifth of U.S. office space vacant. Rents and property values have slumped, and some owners are struggling to pay back loans. Nearly 2% of non-owner occupied CRE loans were overdue by 90 days or more in the second quarter.

Banks are increasing their provisions for loan losses, with credit loss provisions totaling over $23 billion in the second quarter. The situation is worse than it was during the subprime mortgage crisis, but experts believe banks will work through their issues without triggering a full-blown crisis. Some bank losses are inevitable, but they're unlikely to spill over into the broader economy.

Experts are sanguine about the risk posed by CRE distress to the broader economy. Data suggests delinquencies are rising fastest at large banks, which are subject to stringent regulatory oversight. There's also plenty of money sitting on the sidelines to pick up the slack, with private equity firms having allocated over $250 billion to invest in North American real estate. This dry powder is likely to help avert a worst-case scenario where distressed properties become vacant and stifle job creation and municipal tax rolls.