C

hainlink has teamed with Balcony, a real‑estate tokenisation platform that partners with local governments, to deploy its Runtime Environment (CRE). The collaboration will move roughly $240 billion of government‑sourced property data onto the blockchain, enabling parcel‑level land records to become programmable, transparent and verifiable. Balcony’s Keystone platform, powered by CRE, will stream authenticated data directly on‑chain, helping create compliant digital real‑estate markets and reinforcing Chainlink’s growing presence in tokenised real‑world assets (RWAs) where secure, regulated data is critical for institutional trust.

On the same day, Swedish‑regulated asset manager Virtune announced that it has integrated Chainlink’s Proof‑of‑Reserve service across its $450 million portfolio of exchange‑traded products (ETPs). The feature aggregates and reports holdings without revealing individual wallet addresses, giving investors confidence that the ETPs hold the underlying assets.

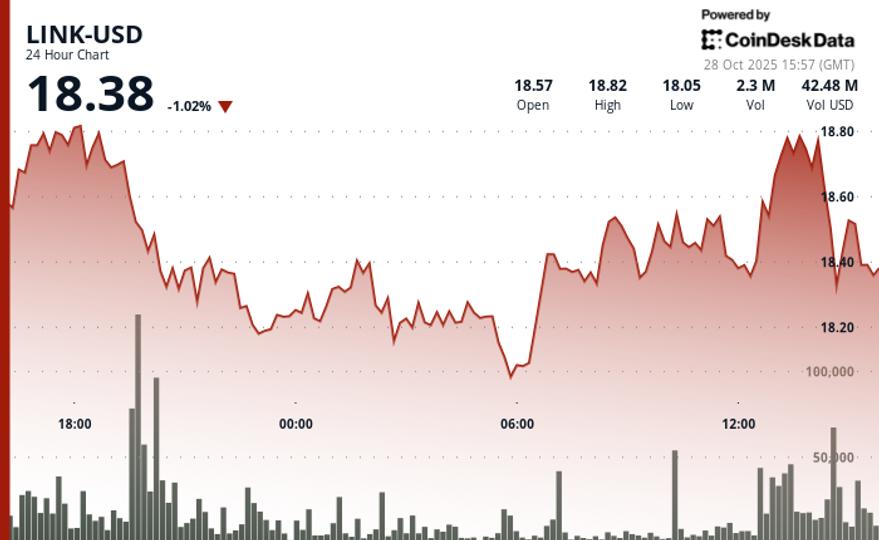

Technical snapshot for LINK: The token sits above $18, with primary support at $18.21 and secondary near $18.30, while resistance remains at $18.82 and a psychological $19 level. A breakout volume of 2.27 million tokens—91 % above the daily average—validated institutional participation. The chart shows an ascending structure that broke its low at $18.04, confirming an uptrend. Immediate upside targets include the $19 psychological level; downside risk is capped near the $18.40 support zone.

The article was partially AI‑generated and reviewed by editorial staff to ensure accuracy, in line with CoinDesk’s AI policy.

Other highlights: OwlTing is developing a stable‑coin payment infrastructure that processes transactions in seconds for fractions of a cent, targeting the $19.4 billion payment volume growth in 2025. Meanwhile, SUI fell 3.4 % on Tuesday, breaking below $2.60 support amid a 180 % volume surge, with nearly 2.7 million tokens traded in a single minute during a late‑day sell‑off.