A

sian banks are facing a new wave of stress as China’s real‑estate unwind continues to ripple through regional credit markets. Over $1 billion in property‑backed loans now sit at a point where extensions or refinancing will decide whether borrowers avoid default.

After months of turbulence, Parkview Group’s $940 million loan, due Friday, adds fresh pressure. The company seeks a one‑year extension, but talks remain unresolved; Taiwanese Bank of Panhsin is still evaluating its rollover portion as of Thursday.

For investors tracking China’s credit pulse, every lender signal suggests the refinancing debate is entering a more delicate phase. HSBC has flagged six warning signs, and its valuation can be tested with a free DCF calculator.

A separate Gaw Capital Partners‑led fund introduces further uncertainty, having missed a payment on a $260 million facility that matured this week. Creditors such as HSBC and Hang Seng Bank may decide on default within days, depending on recovery prospects versus rising sector risks.

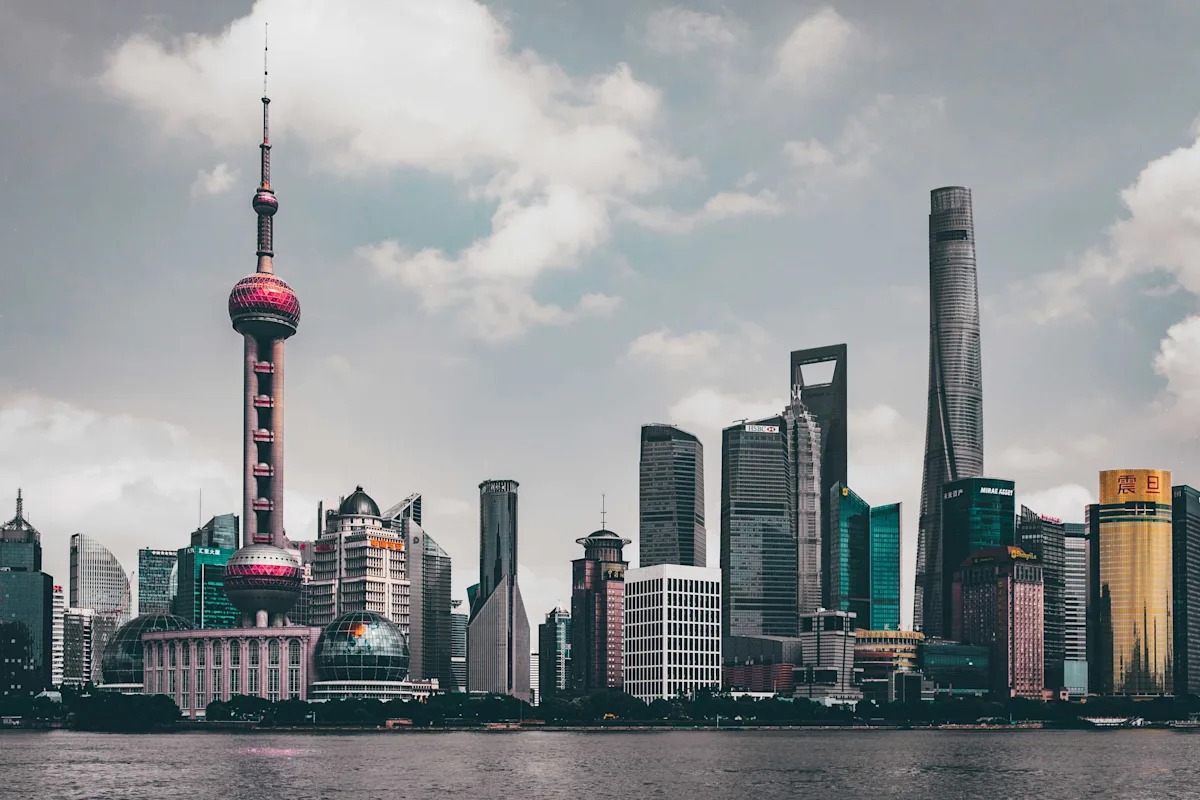

Both Parkview and Gaw loans were created during the real‑estate boom and rely on onshore collateral, offering offshore lenders limited recourse if repayment fails. Attempts to sell assets like Parkview Green in Beijing and Ocean Towers in Shanghai have yet to attract buyers, even as distressed commercial‑property sales reached 114 billion yuan in 2023‑24.

This backdrop pushes banks into uncomfortable discussions about how much exposure they can keep on their books. Gaw is also close to refinancing a $110 million‑equivalent loan tied to a Shanghai life‑science park due Nov. 24, with talks for a new three‑year facility underway.

Parkview secured a three‑month reprieve in August, but lenders worried that Parkview Green’s cash flow was insufficient to service debt. With mainland China and Hong Kong still absorbing years of property‑market weakness, these upcoming maturities could force banks to decide whether extensions stabilize portfolios or merely delay further losses.

Investors watching cross‑border credit lines will likely see these negotiations as another indication that China’s property cycle continues to influence risk appetite across Asia’s financial system.