C

hina's massive stimulus package may not be enough to turn around the nation's troubled property market, according to JPMorgan research. While Beijing has committed to lowering mortgage rates and relaxing downpayment rules, the bank believes these measures won't have a significant impact on housing consumption."These efforts are unlikely to be game changers," strategists led by chief China economist Haibin Zhu said. "We maintain a cautious view on the near-term housing market outlook."

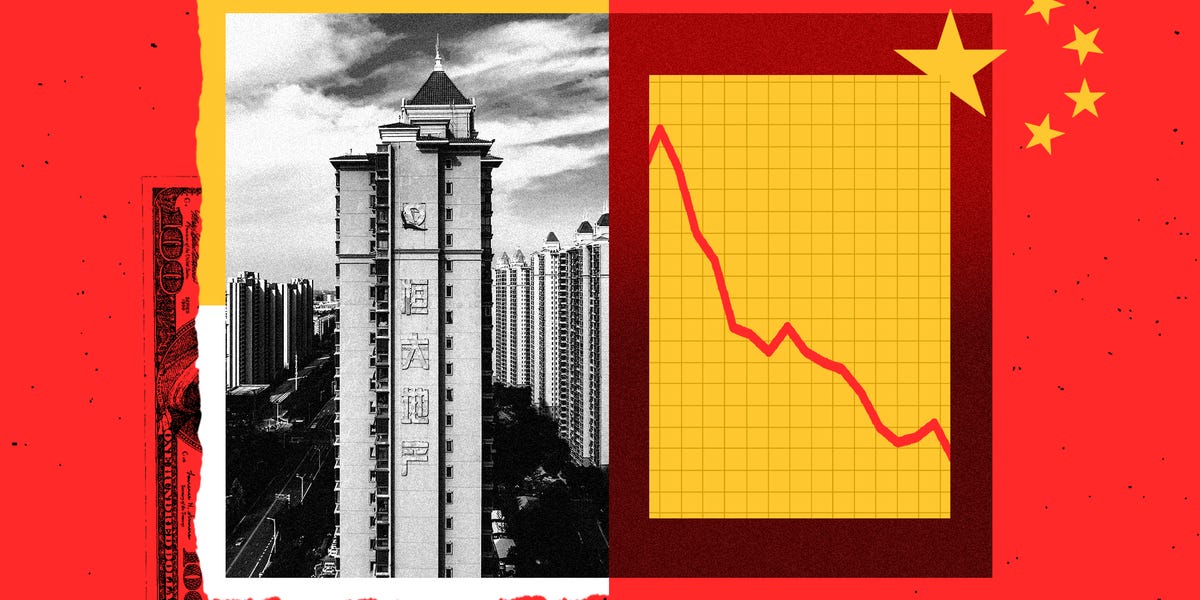

China's property sector has been plagued by high debt and low demand for years, leading to massive developer defaults and comparisons to the 2008 financial crisis. The issue is particularly concerning because real estate accounts for up to 30% of China's GDP.

The government's stimulus package includes measures aimed at boosting housing consumption, but JPMorgan expects these efforts to have unintended consequences. For example, matching existing mortgage rates to new ones could save borrowers about 150 billion yuan, but the bank believes this money will be saved rather than spent.

Lowering the minimum downpayment ratio for second homes from 25% to 15% is unlikely to make a significant difference, as home sales have been weaker than expected. Analysts also point out that previous efforts to incentivize banks and state-owned enterprises to buy up surplus housing inventory have had mixed results.

Other analysts agree that more needs to be done to address the property market's problems. "We've seen plenty of property support measures this year, but they've been insufficient to establish a trough," said Lynn Song, ING's Greater China chief economist. "The PBOC's new measures will help, but we'll likely need to see additional city-level measures ramped up as well."

Aside from housing, JPMorgan sees the broader stimulus package as a positive surprise, with Beijing pledging a major liquidity boost and seeking to reduce interest rates and reserve requirement ratios.