C

hina aims to stop its property slump, top leaders said Thursday in a readout of a high-level meeting published by state media. Authorities "must work to halt the real estate market decline and spur a stable recovery," the readout said, also calling for "responding to concerns of the masses."

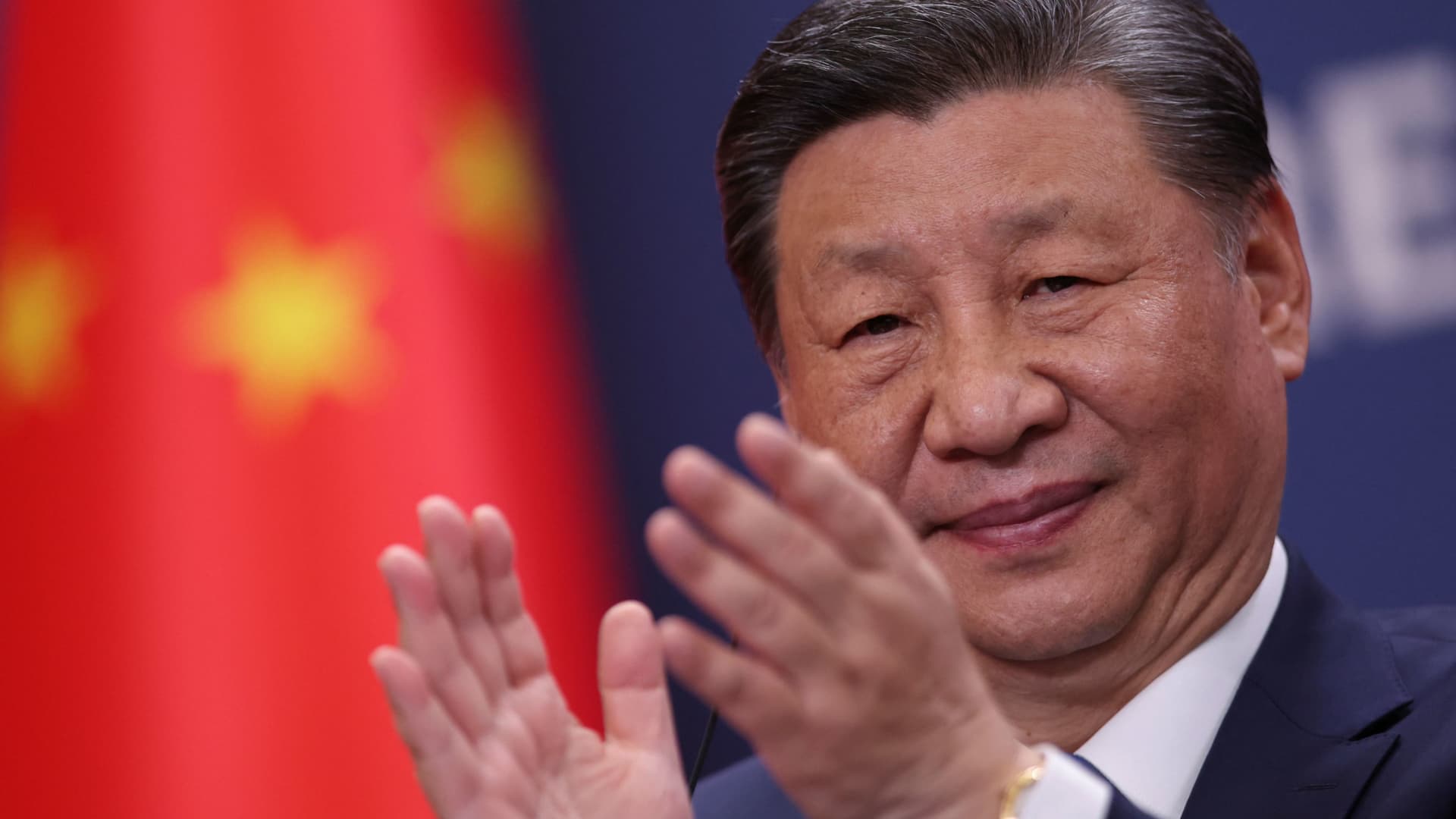

Chinese President Xi Jinping led Thursday's meeting of the Politburo, which touched on issues from employment to the aging population. The readout did not specify the timeframe or scale of any measures.

"I take the messages from this meeting as a positive step," said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. "It takes time to formulate a comprehensive fiscal package to address economic challenges."

Stocks in mainland China and Hong Kong extended gains after the news, with an index of Chinese property stocks in Hong Kong surging by nearly 12%. Real estate once accounted for more than a quarter of China's economy, but its decline has cut into local government revenue and household wealth.

China's broader economic growth has slowed, raising concerns about whether it can reach the full-year GDP target of around 5% without additional stimulus. The People's Bank of China on Tuesday announced a slew of planned interest rate cuts and real estate support.

Thursday's meeting called for limiting housing supply growth, increasing loans for whitelisted projects, and reducing mortgage interest rates. The People's Bank of China said forthcoming cuts should lower the mortgage payment burden by 150 billion yuan ($21.37 billion) a year.

The high-level meeting reflects the setting of an "overall policy," as there previously wasn't a single meeting to sum up measures. Analysts expect Beijing to increase support, noting a shift from focus on stability to taking action.

Tempering growth expectations, the meeting readout said China would "work hard to complete" its full-year economic targets, which is less aggressive than previous statements. This signals policymakers are looking for middle ground between short-term growth and longer-term efforts to address structural issues.

Goldman Sachs and other firms have trimmed their growth forecasts in recent weeks. The change in tone about the economic targets suggests "the government may tolerate growth below 5%," said Yue Su, principal economist China at the Economist Intelligence Unit.