B

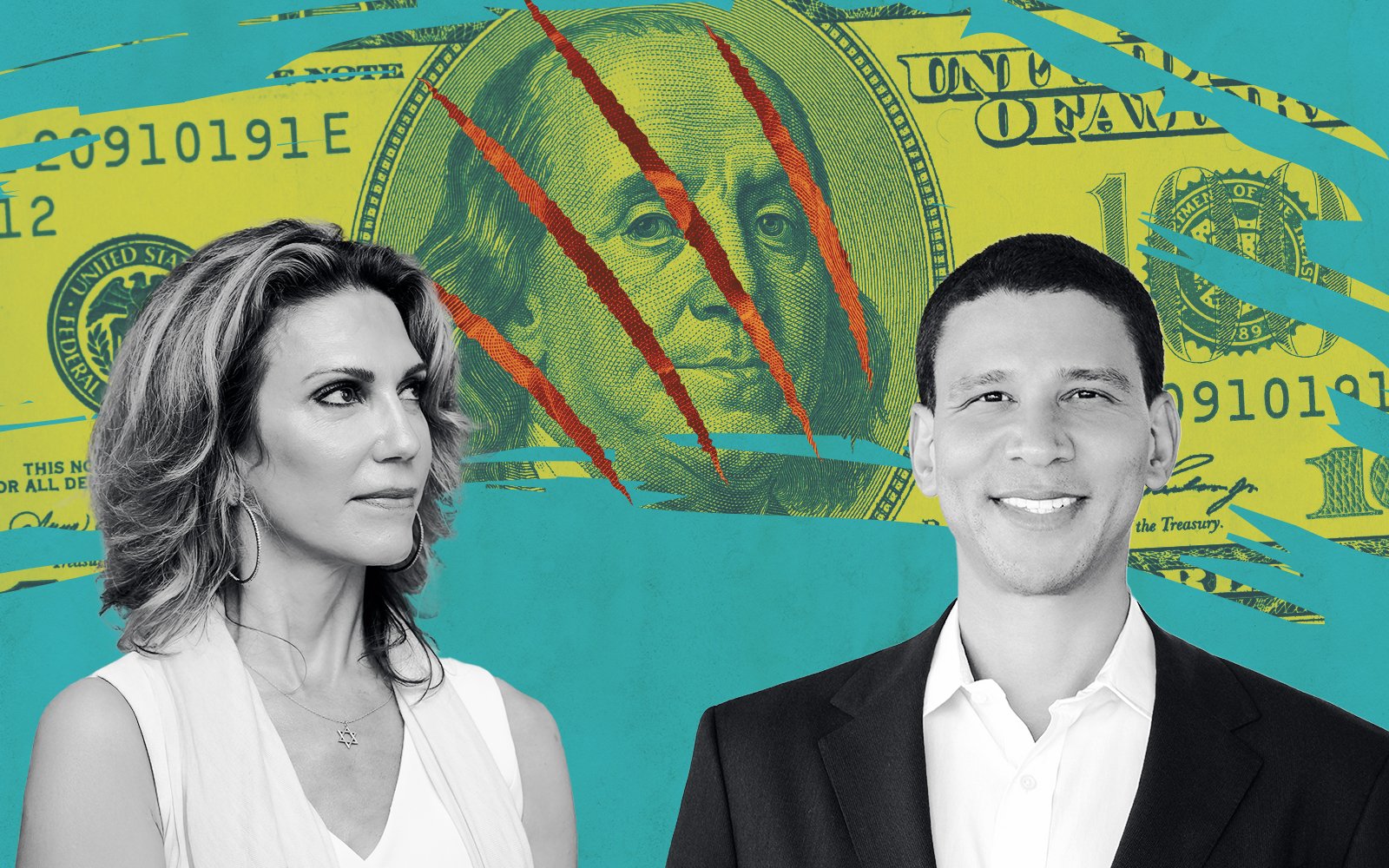

rown Harris Stevens (BHS) has filed a lawsuit against former agent Scott Harris, alleging that the brokerage is trying to recover more than $400,000 it says he owes after he left the firm in January. Harris, who had been with BHS for two decades, departed to start his own business while still holding 12 active listings that were expected to bring in roughly $290,000 in commissions once closed. After the sales were recorded, BHS demanded repayment of perks and bonuses that the agent had earned, claiming the firm would retain the pending commissions as part of the clawback.

Harris argues that the clawback provisions should not apply. He says BHS failed to deliver on several promises, including a private office for his team and the full bonus he earned in 2024. He also contends that the investments the firm made in his business had already vested, meaning the window for a clawback had closed. His case echoes a similar lawsuit by former colleague Chris Poore, who sued BHS after leaving the firm and was found to have been unaware of the clawback policy. A judge granted Poore summary judgment on two of his claims, a decision that could signal how courts may view future clawback disputes.

The rise of clawbacks in the real‑estate sector began when Compass attracted agents with generous sign‑on bonuses and “sweetheart” deals, only to lock them into long contracts. Other brokerages, unable to compete, started buying out agents they wanted, which drove up costs and led them to institute their own clawback policies. During the pandemic’s boom, many agents stayed put, and those who left could rely on brokerages to enforce these policies. As the market cooled, brokers who were losing income sought new talent, and the cost of recruiting top producers became a point of contention, now playing out in court.

In other real‑estate news, bestselling author Amor Towles sold his 1,600‑square‑foot condo at 1 Bleecker Street for $2.6 million. The two‑bedroom, two‑bathroom unit, originally a gutted loft in the 1990s, featured exposed brick and a clawfoot tub. Towles and his wife, Margaret, had lived there for 15 years before buying a townhouse in Gramercy Park for $6.9 million in 2005. The listing was handled by Engel & Völkers agents Paul Gavriani, Vincent Falcone, and Darielle Hertz.

The most expensive transaction of the week was a West Village townhouse at 83 Jane Street, sold for $14.6 million. The five‑story, 5‑bedroom, 4‑bath home, converted from an apartment building in 1999, featured a roof deck, garden, and balcony. Film director Tanya Wexler, known for the 2011 film “Hysteria,” sold the property to an LLC buyer. Compass’s Hudson Advisory Team listed the home, while Douglas Elliman’s Raymond Dillulio represented the buyer.