T

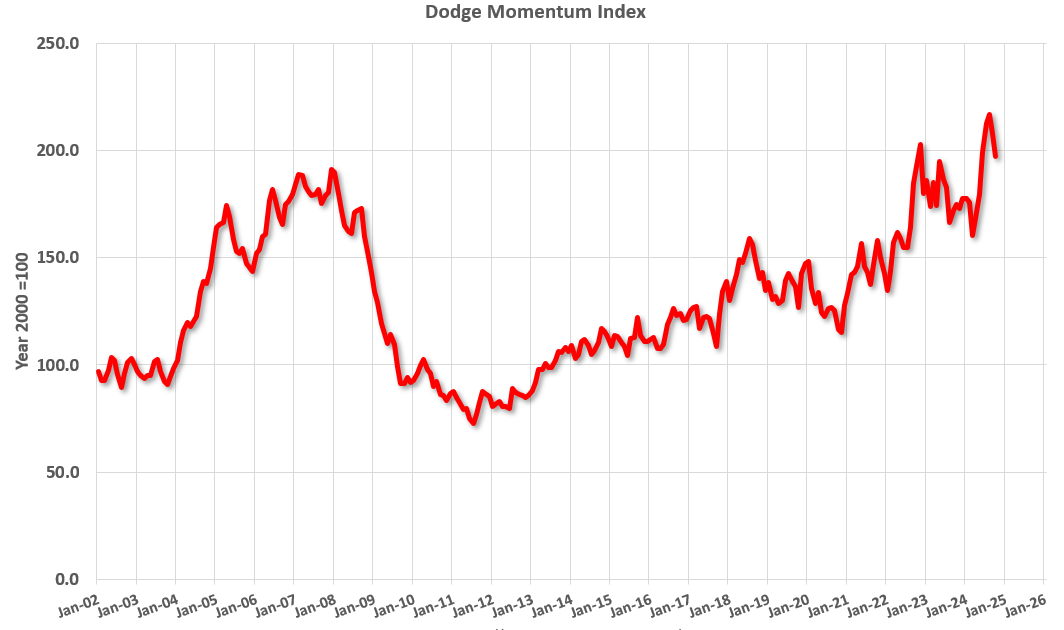

he Dodge Momentum Index (DMI) declined 5.3% in October to 197.2 from the revised September reading of 208.2. Commercial planning fell 6.7%, while institutional planning dropped 2%. According to Sarah Martin, associate director of forecasting at Dodge Construction Network, a moderate pullback in nonresidential sectors and normalizing data center planning contributed to the decline.

Despite this, owners and developers remain optimistic about next year's market conditions. The DMI was 13% higher than October 2023 levels, with commercial segments up 18% and institutional segments up 3%. However, if data centers are removed from the equation, commercial planning would be down 4% from last year, and the entire DMI would be down 2%.

The DMI is a leading indicator of nonresidential construction spending, typically leading by a full year. The index suggests a slowdown in early 2025, but a pickup in mid-2025. Commercial construction tends to lag behind economic trends, making it a less reliable indicator for near-term changes.