T

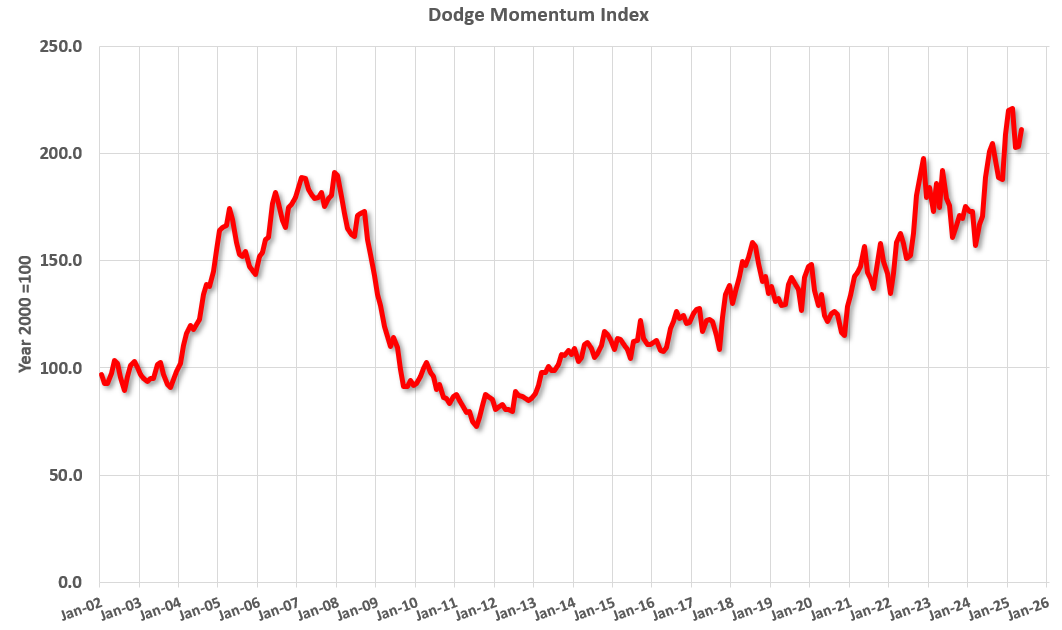

he Dodge Momentum Index (DMI) rose 3.7% in May to 211.2, with commercial planning increasing 0.8% and institutional planning improving by 10.5%. Nonresidential planning accelerated due to strong project activity on the institutional side, driven by education and recreational projects.

Data center projects returned to typical levels after a strong April, constraining overall commercial planning. Without data centers, the DMI would have grown 7% in May. Accelerated warehouse and hotel planning drove commercial gains, while office and retail planning remained flat.

The DMI was up 24% from year-ago levels, with the commercial segment increasing 15% and the institutional segment rising 47%. Excluding data center projects, commercial planning would be up 4% and the entire DMI would be up 17%.

The DMI is a leading indicator of nonresidential construction spending, shown to lead by a full year. The index suggests a pickup in mid-2025, but uncertainty may impact these projects. Commercial construction tends to lag economic trends.