L

enders' foreclosure activity in the Chicago area slowed down in July and August. In Cook County, 731 foreclosure lawsuits were initiated by lenders in July, followed by 645 in August. While these numbers are higher than June's total of 623, they are lower than May's 845. March still holds this year's high for foreclosure starts at 1,030.

The combined value of mortgages behind the foreclosure efforts in July and August totaled $373 million. In July, $217 million worth of mortgages were involved, while in August it was $156 million. The median mortgage value that fell into foreclosure in July was $178,703, and in August it was $171,830.

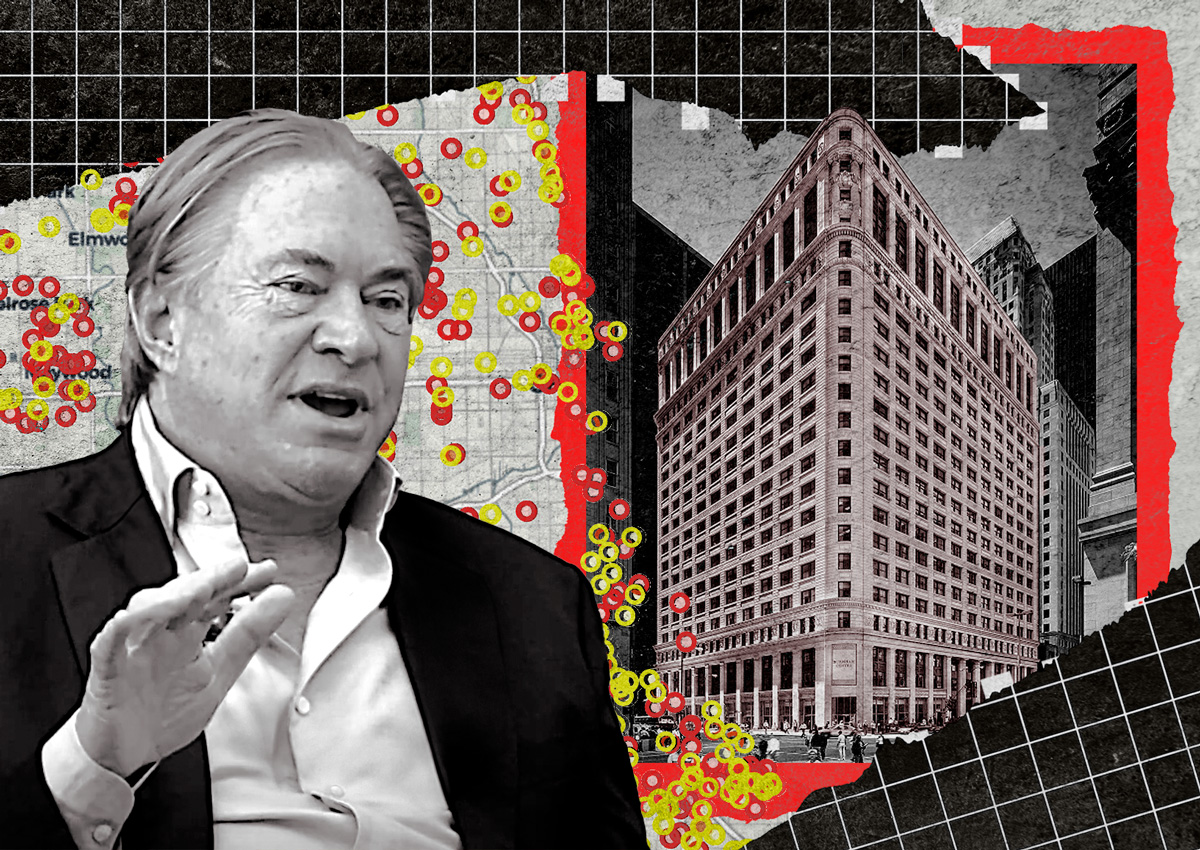

The largest foreclosure filing in the past two months was the 584,000-square-foot Burnham Center, valued at $42 million. Wells Fargo filed a lawsuit against the property's owner, Shidler Group, as part of its role overseeing a trust that served as the lender.

U.S. Bank led the pack with 92 and 94 foreclosure complaints in Cook County for July and August, respectively. Nationally, foreclosure filings slowed down in August, with an 11% decline from the same time last year. Chicago has one of the highest foreclosure rates in the nation, with one in every 2,450 housing units facing foreclosure.

The total value tied to mortgages going through the foreclosure process was lower in July and August compared to May and June. The largest mortgage involved in a foreclosure lawsuit in April was $305 million for GEM Realty and Farallon Capital's office property at 70 West Madison Street.