C

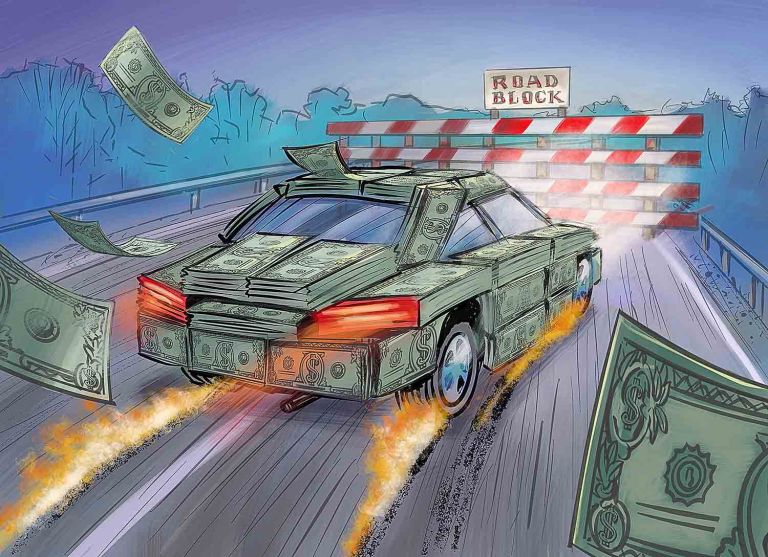

ommercial real estate collateralized loan obligation (CRE CLO) issuance surged to $6.8 billion as of September 20, 2024, surpassing the total for 2023's $6.7 billion, according to Green Street data. However, this growth was accompanied by rising distress due to increasing interest rates.

Ten top CRE CLO issuers experienced growing levels of distress through July 31, with Fortress and Granite Pointe leading the pack at 31.3% and 28% delinquent loans, respectively. Loan modifications were also prevalent among top issuers, including KKR (75.2%), Arbor Realty Trust (60.4%), and Granite Pointe (60.3%).

CRE CLOs have built-in safeguards to protect bondholders, unlike collateralized debt obligations that contributed to the 2008 Global Financial Crisis. However, these short-term floating-rate loans issued for transitional commercial properties are facing challenges in today's higher interest rate environment.

Mike Haas of CRED iQ attributes distress in CRE CLOs to a heavy reliance on pro-forma underwriting, which assumes borrowers can execute business plans to achieve higher rents and profits. As interest rates rise, borrowers struggle to afford high debt service amounts due to lower-than-expected rents.

According to Moody's Ratings, the 60-day delinquency rate for CLOs stands at 3.3%, significantly lower than other distress rates in the CMBS universe. Darrell Wheeler notes that while CLOs have higher leverage points and additional borrowing from mezzanine lenders, senior debt has largely survived.

Deryk Meherik of Moody's Ratings suggests that challenges facing CLOs stem from the low-interest environment of the late 2010s and early 2020s. The Federal Reserve's interest rate cut should provide relief as borrowers begin leasing up their properties after a transition period in 2022-2023.

Moody's data shows that managers of revolving pools replaced troubled assets with an average of three months of impairment between 2018 and 2023. While higher interest rates have led to challenges for CLO managers, Meherik believes there hasn't been enough volume to cause a market slowdown.

The damage to CLOs from interest rate increases varies greatly depending on property sectors, with Class B office assets being hit particularly hard due to lower rents and inability to refinance at higher borrowing costs.