C

hicago is at the forefront of a global trend as data centers become one of the fastest-growing real estate asset classes, driven by artificial intelligence (AI), machine learning (ML), and cloud computing. According to Cushman & Wakefield's 2025 Global Data Center Market Comparison report, analyzing 97 global markets, power access, land availability, and infrastructure scalability are now the top factors influencing data center development.

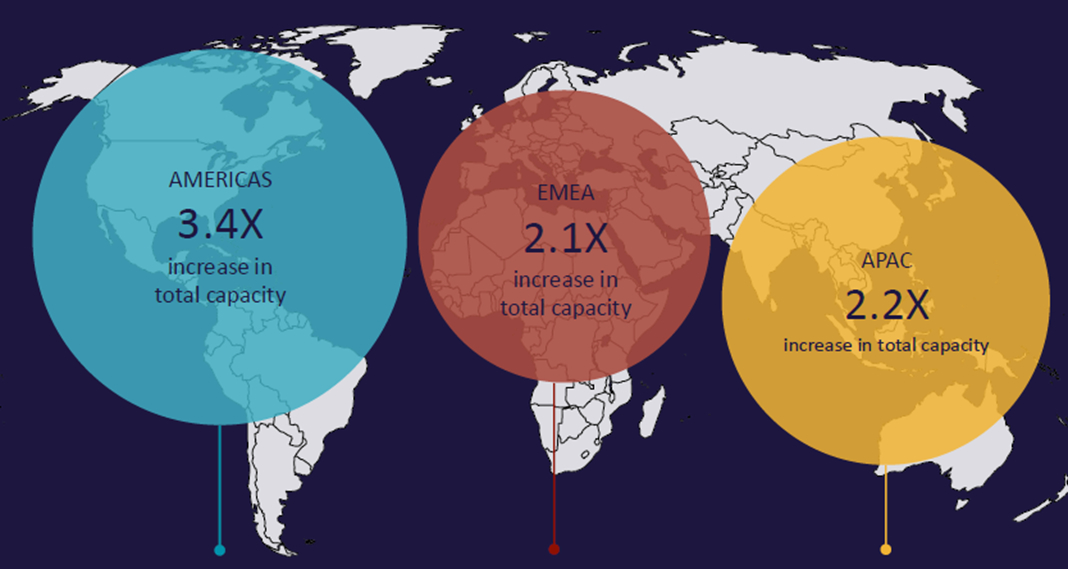

"We expect total capacity to continue its rapid growth across all regions, with each expected to at least double based on current pipelines," said John McWilliams, Head of Data Center Insights at Cushman & Wakefield. Land with guaranteed utility access is now the gold standard, as data centers become more power-intensive and land with pre-secured electrical capacity is fiercely contested by developers, EV manufacturers, and semiconductor firms.

Record development pipelines are fueling demand, particularly in North America, where the Americas lead globally in planned capacity. Virginia alone accounts for 15.4 GW of planned capacity, the highest in the world, followed by Phoenix, Dallas, and Atlanta, which are shifting toward suburban and rural locations with more abundant land and feasible power integration.

Established markets like Virginia, Beijing, and London top the list due to mature infrastructure and strong connectivity, but face rising land costs and power constraints. Emerging markets like Austin/San Antonio, Auckland, and Abu Dhabi are gaining momentum due to affordable land, scalable infrastructure, and favorable economic environments.

"The next frontier isn't just about connectivity; it's about access to scalable land, power infrastructure, and favorable economics," McWilliams explained. Institutional capital is flowing into the sector at record levels, with joint ventures, mergers, and acquisitions on the rise across colocation, hyperscale, and infrastructure segments.

Top emerging markets include Iowa, Pennsylvania, and Indianapolis in the US, which offer cost-effective alternatives to pricier regions. Land costs remain lower in the Americas, but rising competition has driven up pricing in major hubs, making Midwestern cities like Indianapolis and Iowa more attractive options for spillover demand from saturated metros.