D

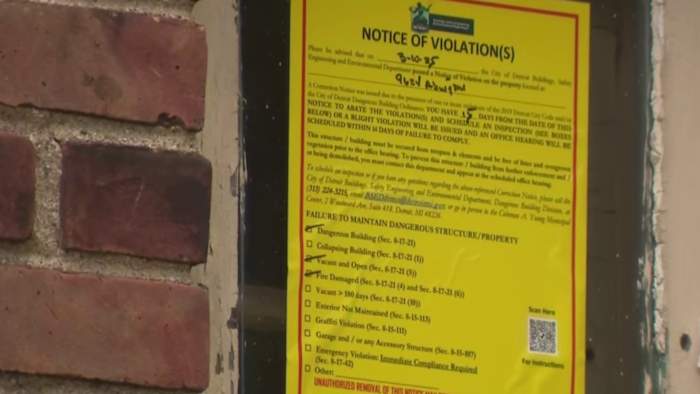

etroit officials have launched a massive nuisance abatement lawsuit against RealToken, a cryptocurrency-based real estate platform, citing widespread code violations and unsafe living conditions across hundreds of properties. The lawsuit targets over 400 homes owned by the company, which has accumulated approximately $500,000 in fines for neglect and hazardous conditions.

RealToken's complex business model allows multiple investors to own shares of individual properties through a network of 165 different LLC entities, making it difficult for city officials to hold anyone accountable. "We're exposing vulnerable tenants to unsafe conditions," said Detroit City Council member Angela Whitfield Calloway. "They deserve housing dignity like everyone else."

Tenant Sylvia Young described serious maintenance issues at her rental property on the west side, including a leaking roof and structural damage. The city's Corporation Counsel, Conrad Mallett, emphasized that property owners should be held accountable for their actions.

RealToken acknowledged past management issues but defended its commitment to Detroit, claiming it has been "victimized by unscrupulous property management companies." Since December 2024, the company says it has established its own property management team and begun addressing violations. However, city officials remain skeptical, emphasizing that responsible property management is essential for investment in Detroit.

"This practice will not continue here," said Whitfield Calloway. "They need to move on somewhere else." The case highlights broader concerns about property management and tenant rights in Detroit, where 60 percent of residents are renters.