P

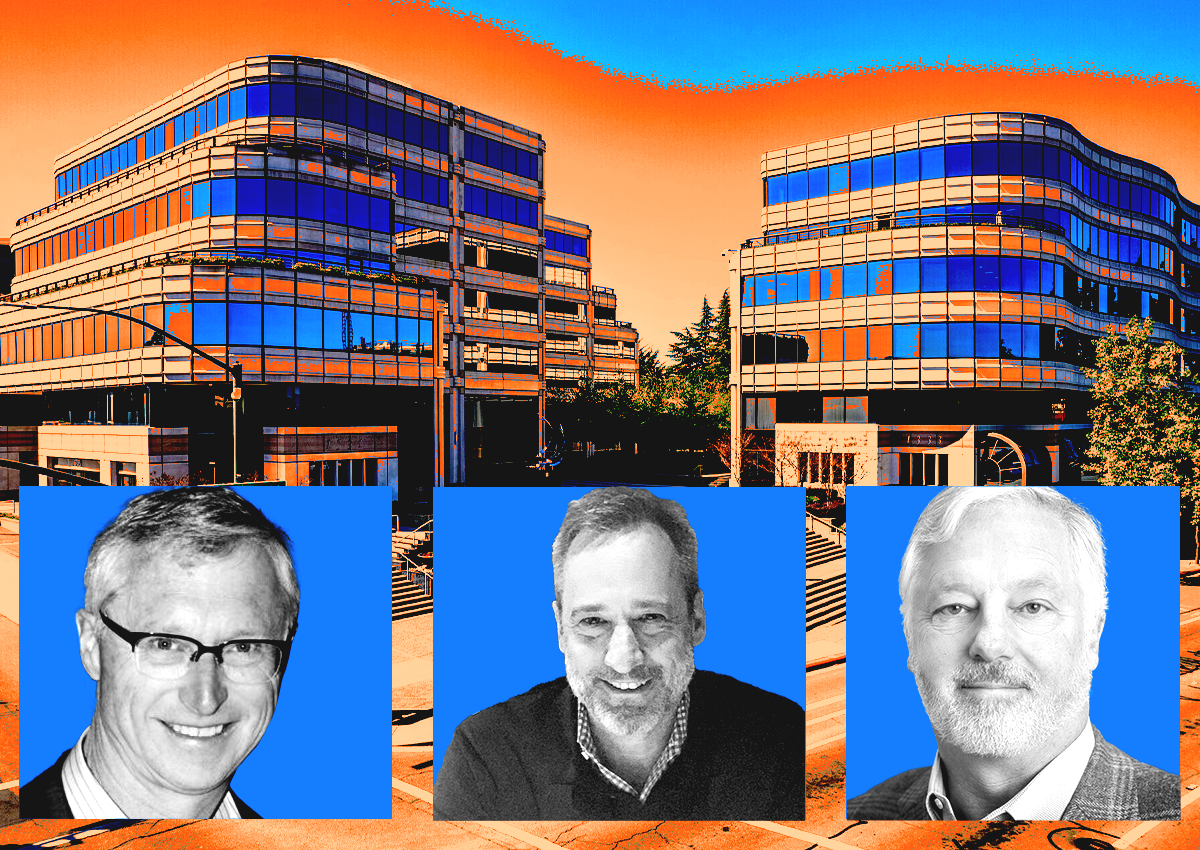

SAI Realty Partners has made a significant investment in Downtown Walnut Creek, purchasing an office complex at a price of $477 per square foot. This is roughly double the cost of similar properties in San Francisco. Led by Peter Sullivan, who is based in San Francisco, PSAI paid $167 million for the 362,400-square-foot Plaza at Walnut Creek.

The property, located at 1331 and 1333 North California Boulevard, boasts a 93% occupancy rate and features amenities such as an executive conference room, full-service deli, and 24-hour security. The complex is situated near shops, restaurants, and the Walnut Creek BART station, offering stunning views of Mount Diablo.

The sale marks one of the highest prices paid for an office property in the East Bay, according to Jeffrey Weil of Colliers. Weil noted that the pandemic has led to a shift towards remote work, causing office vacancy rates to rise and prices to fall in the Bay Area. However, PSAI's purchase suggests that some investors remain confident in the region's commercial real estate market.

The Plaza at Walnut Creek was sold by New York City-based Clarion Partners, with a platoon of Newmark brokers arranging the deal. Steven Golubchik, one of the brokers, described the property as a "once-in-a-generation opportunity" for investors. PSAI Realty Partners has invested heavily in the Bay Area, but lacks an official website and has undergone several name changes since its founding in 2006.