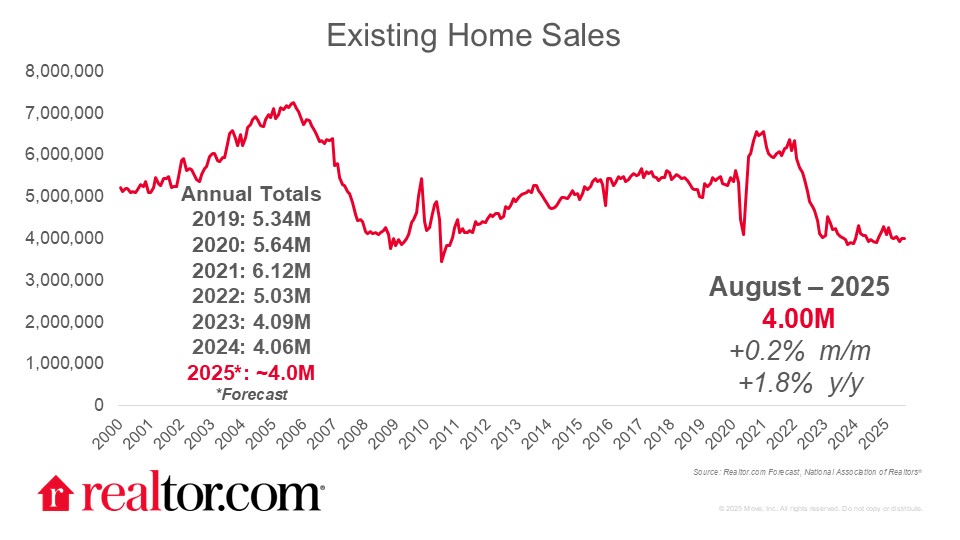

A

ugust 2025 existing‑home sales slipped 0.2 % from July, settling at a seasonally adjusted 4 million units. The figure still outpaced last year’s 3.93 million by 1.8 %, marking the second straight month of year‑over‑year gains. Pending sales in July were modest but also up versus the previous year.

Mortgage rates fell in June and July, easing affordability for many buyers. However, the steady decline may have dampened urgency, as consumers now expect rates to stay low. Although rates remain above the sub‑6 % range that still benefits most homeowners, the modest drop helps those on the margin and could spark a more active fall market. Seasonal patterns suggest fall is the optimal time to buy, with reduced competition and ample inventory softening prices and favoring flexible buyers.

Nationwide, home‑price growth persisted. The median sale price rose 2 % from a year ago to $422,600, while the typical asking price held steady in August. Months’ supply, a gauge of inventory versus demand, fell to 4.6 months in July and stayed flat in August, just below the nine‑year high of 4.7 months reached in June.

Local dynamics remain critical. More than half of the 50 largest markets diverge from the national trend: 7 markets have shifted to buyer‑friendly conditions, whereas 20 still favor sellers. Buyer markets cluster in the South and West, while seller markets dominate the Northeast and Midwest. Price growth reflects this split, with the Northeast up 6.2 % and the Midwest 4.5 %, compared to the South’s 0.4 % and the West’s 0.6 %. Working with a real‑estate professional who knows the local market is essential for setting realistic expectations and crafting effective strategies in today’s varied housing landscape.