F

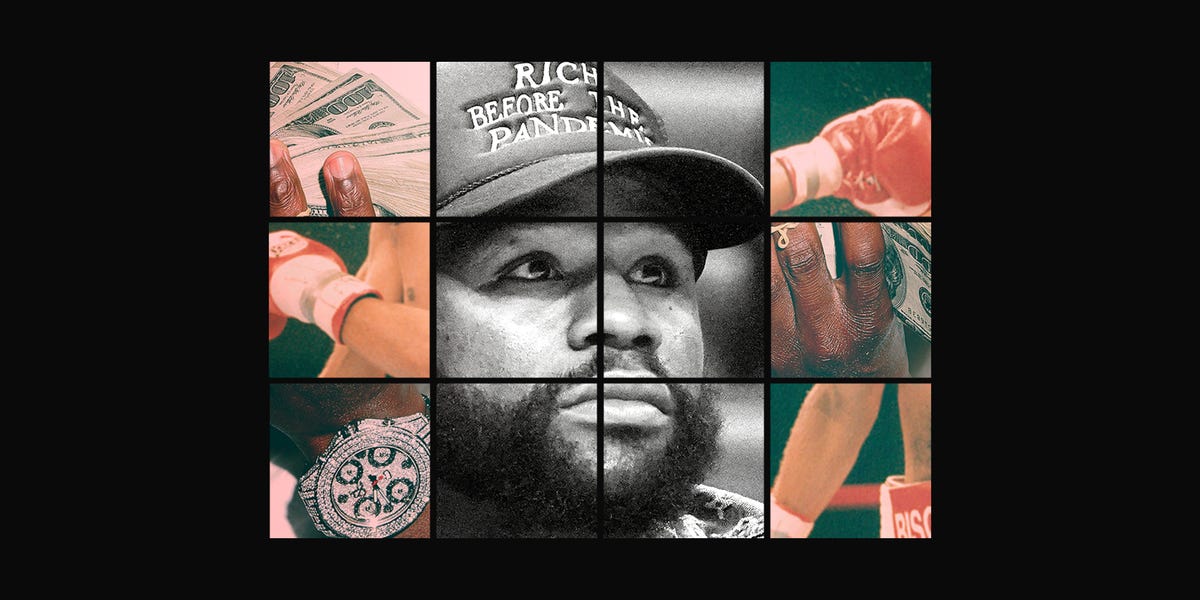

loyd “Money” Mayweather, the 48‑year‑old former champion, still flaunts his riches on social media, but behind the glossy jet‑cabins and stacks of cash lies a tangled web of debt, lawsuits, and questionable business deals. In a September clip he counted $100 bills on a private‑jet floor, shrugging off criticism with the line, “Continue to hate. I’m a winner.” That same year, he retired undefeated (50‑0) and had earned over a billion dollars in pay‑days, placing him among the top‑earning athletes ever.

After boxing, Mayweather built a brand around luxury: Bugattis, Richard Mille watches, Gucci, and a portfolio of debt‑free real‑estate in Los Angeles, Miami, and Las Vegas. He claimed in 2021 that every property, jet, and car was paid for, and that he owned “billion‑dollar buildings.” Yet a Business Insider audit revealed he had taken out millions in mortgages on his homes last year and faced liens for a Mercedes Maybach, jet fuel, and unpaid trash at his Las Vegas mansion.

Mayweather’s foray into commercial real‑estate began in 2024 when he announced a $100‑million investment in a Manhattan high‑rise portfolio owned by Go Partners. He later claimed to have bought a $402‑million block of rent‑regulated apartments in Upper Manhattan, declaring sole ownership. Public records, however, show no outright sale and that his initial equity was absorbed by Go Partners, leaving him with no stake. The portfolio was later spun off into a public company.

Two of Mayweather’s commercial properties were foreclosed in the past 18 months, and he risks losing a Las Vegas strip‑club building over $52,000 in back taxes. Creditors have sued him for unpaid luxury items, including watches and jewelry. Air Mayweather, his Gulfstream jet, was sold in December, and he has sold his Beverly Hills and Miami mansions to real‑estate partners. A convicted felon on his team has been named in several lawsuits against the boxer.

Attorney Mark Tratos, who represented Mayweather in his fighting career, warned that the boxer’s lack of professional oversight has exposed him to risk. Mayweather’s lawyer, Bobby Samini, insists the fighter is “not experiencing financial strain” and works with seasoned professionals. Samini also highlighted Mayweather’s rise from poverty to a $1 billion‑plus empire, dismissing negative narratives.

Mayweather’s business acumen began in 2007 when he bought out his promoter contract and founded Mayweather Promotions, cutting out middlemen and securing larger shares of PPV, ticket, and concession revenue. He rebranded from “Pretty Boy Floyd” to “Money Mayweather,” embracing a villainous persona that boosted his marketability. In the ring, his defensive style and counterpunching earned him 50 wins, but fans craved drama.

His post‑boxing wealth was largely tangible: cash, cars, and real‑estate. David Levi, a former associate, noted Mayweather’s preference for seeing money in hand. Accountant Dave Hall warned of heavy spending without adequate tax reserves. In 2017, Mayweather paid $22.2 million in back taxes to the IRS; in 2023 he settled for $5.5 million plus $1.1 million in penalties.

After retirement, Mayweather’s core team fractured. He left manager Al Haymon and CEO Leonard Ellerbe, and his uncle trainer Roger died in 2020. His father, a former boxer, suffers from dementia. A new key figure is Jona Rechnitz, a former LA jeweler and government informant involved in a $20 million hedge‑fund scandal. Rechnitz has sued for unpaid loans and jewelry, with some cases settled and others resulting in judgments, including a $17.7 million award in 2023. Despite this, Mayweather credits Rechnitz as a pivotal partner in his post‑boxing ventures.

Mayweather and Rechnitz travel together, attending NBA games and public events. Rechnitz’s influence has expanded Mayweather’s real‑estate ambitions. The boxer’s first real‑estate deal came after meeting NYC executives at a Knicks game; he invested $5 million in a property that yielded $50,000 monthly, a 12% return. In December, he reportedly bought a Diamond District building for $20 million as a gift for his grandson, though records show a different buyer.

In early 2024, Rechnitz introduced Mayweather to billionaire lender Don Hankey. Hankey, known for a $175 million bond for Trump, loaned Mayweather $54 million at ~9% interest, using 14 residential homes, a Las Vegas strip‑club, and a jet as collateral. The loan was cross‑collateralized, meaning multiple assets could be seized if Mayweather defaulted. Hankey noted Mayweather’s wealth was largely tied to real‑estate equity, with little credit history.

While borrowing, Mayweather’s other properties fell into trouble. A Las Vegas commercial building he bought for $3.6 million in 2024 was sold back to its original owner at auction. Two Trump Las Vegas condos were seized for unpaid taxes, later returned after a $21,000 payment. A $568.63 lien was placed on his Las Vegas mansion for unpaid trash. A Texas aviation supplier sued for $137,000 in unpaid bills, and the FAA recorded a $358,000 lien for maintenance. Former pilot AJ Ramey sued for unpaid jet debts, though Mayweather settled the maintenance bill and the lien was removed in August. Ramey remains owed money for pilot services; Mayweather denies the claim.

In 2023, a Los Angeles court awarded a Nigerian media company $2.4 million for unpaid appearances in Africa, a judgment now nearly $3 million with interest. Mayweather has appealed but the judgment remains unpaid.

Mayweather’s penchant for cash is well documented; former associates note his love for seeing money flow. Rechnitz appears in several lawsuits against Mayweather, including a 2024 suit from Miami jeweler Leonard Sulaymanov for a $3.9 million jewelry bill. Mayweather never responded, and the case settled out of court. A Las Vegas car dealer sued for a $1.2 million Mercedes Maybach, leading Mayweather to sue for fraud. Both cases are pending.

Three lawsuits involve Mayweather and Rechnitz for alleged fraud in a cryptocurrency pump‑and‑dump scheme and a ticket resale operation. Both deny wrongdoing. In a separate case, Miami entrepreneur Jayson Winer sued Rechnitz, Mayweather, and property CEO Ayal Frist for failing to deliver promised access to celebrities, including Elon Musk. Winer claimed Mayweather’s name was used to promote a Musk‑involved NFT auction. Mayweather sued for defamation and was removed from the suit; Rechnitz and Frist countered that they fulfilled their obligations.

John Berman, who sold Mayweather a Los Angeles warehouse for $4.5 million in late 2022, claims Mayweather defaulted on a December 2024 payment. Berman says Rechnitz pressured him to refund a $1.5 million down payment, leading Berman to foreclose and seize the property.

Beyond real‑estate, Mayweather’s brand extends to supplements (One of One), water (Agua Plus), betting (Betify), and a personal injury law firm gala. He has endorsed cryptocurrency coins, with a 2018 SEC settlement of $600,000 and a subsequent investor lawsuit. His gym chain, Mayweather Boxing and Fitness, was sold in August; many franchises have sued for misleading statements. Exhibition fights against Logan Paul, John Gotti III, and an upcoming match with Mike Tyson generate multimillion‑dollar paychecks.

Mayweather’s Instagram remains a showcase of wealth: “I fear NO man but GOD! Let’s get it!! 💰.” He filed a defamation suit against Business Insider over real‑estate reporting; the case is pending. Business Insider maintains its coverage. The story reflects the complex, high‑stakes world of a former champion turned entrepreneur, where opulence, debt, and legal battles intertwine.