A

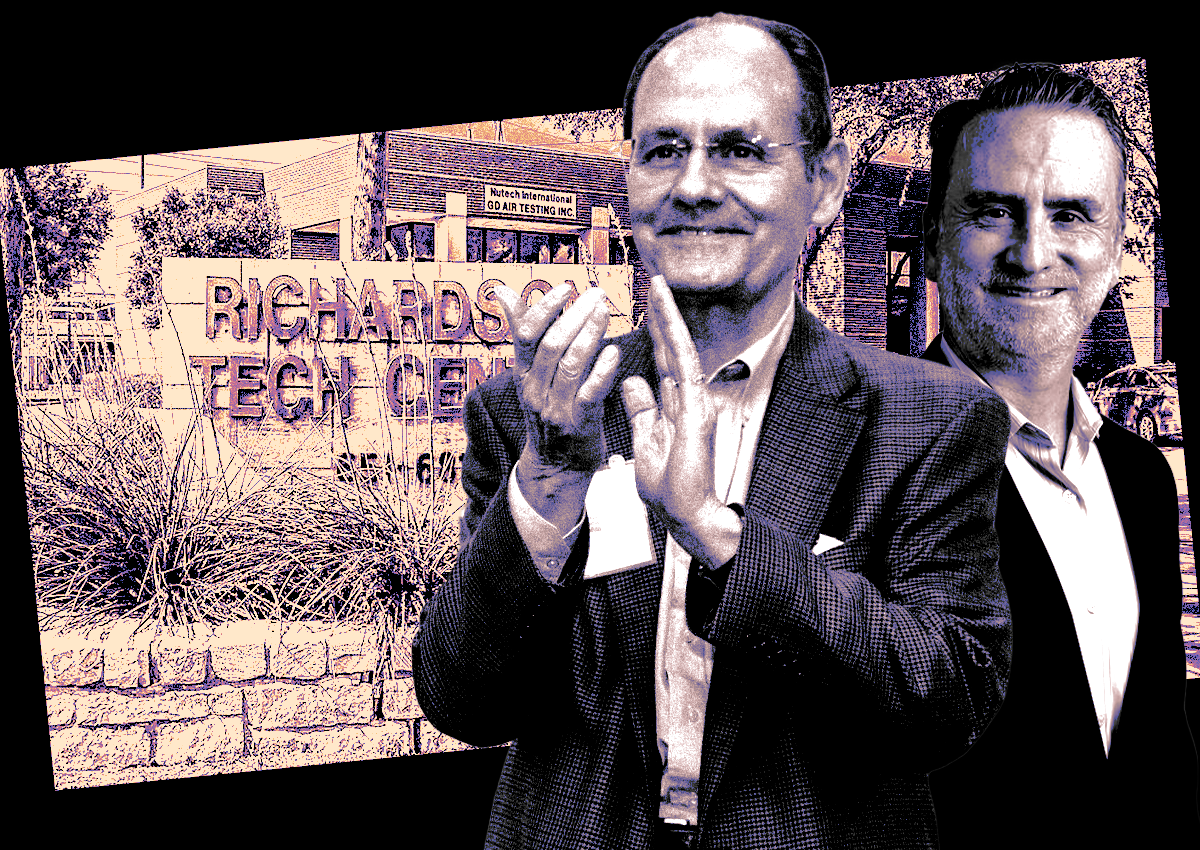

lan Hartman's Hartman Properties recently offloaded Richardson Tech Center, a four-building showroom complex located at 651 Plano Road. This transaction was made under the Hartman's firm's umbrella. The buyer was an entity associated with Addison-based real estate investor Entrada Partners. Although the sale price was not disclosed, Hartman's firm stated that it was nearly double the $5 million they paid for the property through Hartman REIT XXI, Inc. in 2018. According to appraisal district records, the property was valued at $8.6 million in 2024. When Hartman purchased the property in 2018, it was 73 percent occupied; currently, it is 95 percent occupied, as per the company's statement.

San Antonio-based lender Zions Bancorporation, also known as Amegy Bank, provided the financing for Entrada. However, loan documents did not disclose the mortgage amount. Alan Hartman is the former CEO of Houston-based Silver Star Properties. He was ousted from the company amid allegations of mismanagement. Specifically, the board claimed Hartman borrowed millions in unauthorized debt and was accused of nepotism involving his daughter Margaret Hartman.

The alleged mismanagement led to the firm defaulting on a $259 million CMBS loan from Goldman Sachs tied to 39 properties in Oct. 2023, as per the board's claims. Furthermore, Hartman has been accused of sabotaging the company since his departure. He has denied all allegations.

The SEC opened an inquiry into the firm in February. To address its financial woes, Silver Star is selling off its portfolio of office, industrial, and retail properties and is pivoting towards self-storage. On September 2, Gerald Haddock provided an update on the firm's strategy pivot. He stated that Silver Star sold 28 of its 47 legacy assets and plans to sell another 11 legacy properties before the end of the year. This liquidation of legacy assets includes the sale of Richardson Heights, a retail strip that Silver Star sold for $40.5 million, as per SEC filings. This transaction was approximately $202 per square foot.