R

aising real estate investment capital has become increasingly challenging due to ongoing pandemic impacts, rising interest rates, inflation, and investor uncertainty. The average time to close a deal has nearly doubled, from 20.9 months in 2019 to around 11.2 months. This shift reflects broader market trends, with regulated open-end fund assets increasing by 1.5% to $70.20 trillion at the end of Q2 2024.

In response to this shift, our team at InvestNext has developed a whitepaper outlining five key trends for real estate fundraising in late 2024 and into 2025. One key insight is that syndicators who adopt fund structures will be able to access and deploy capital quickly, enabling them to pivot without operational delays while providing diversified offerings to investors.

Investor behavior is altering the syndication landscape, with a decline in single-asset strategies and an increase in demand for more stable, long-term investments. Syndicators are adapting by diversifying their offerings and incorporating fund structures into their strategy. This approach enables them to raise more capital, create a wider array of opportunities, and adapt quickly to market shifts.

Preqin forecasts real estate assets under management to surge to $2.66 trillion by 2029, representing an 8.7% annual growth rate. Coupled with the recent spike in the Cboe Volatility Index, this presents a significant opportunity for adaptable syndicators who can pivot their capital-raising approach.

Fund structures offer more than just diversification – they're a path to operational efficiency by consolidating reporting and investor communications, reducing overhead, and allowing syndicators to redirect resources to critical activities. Well-implemented fund structures can improve capital access by clearly communicating the investment thesis to LPs.

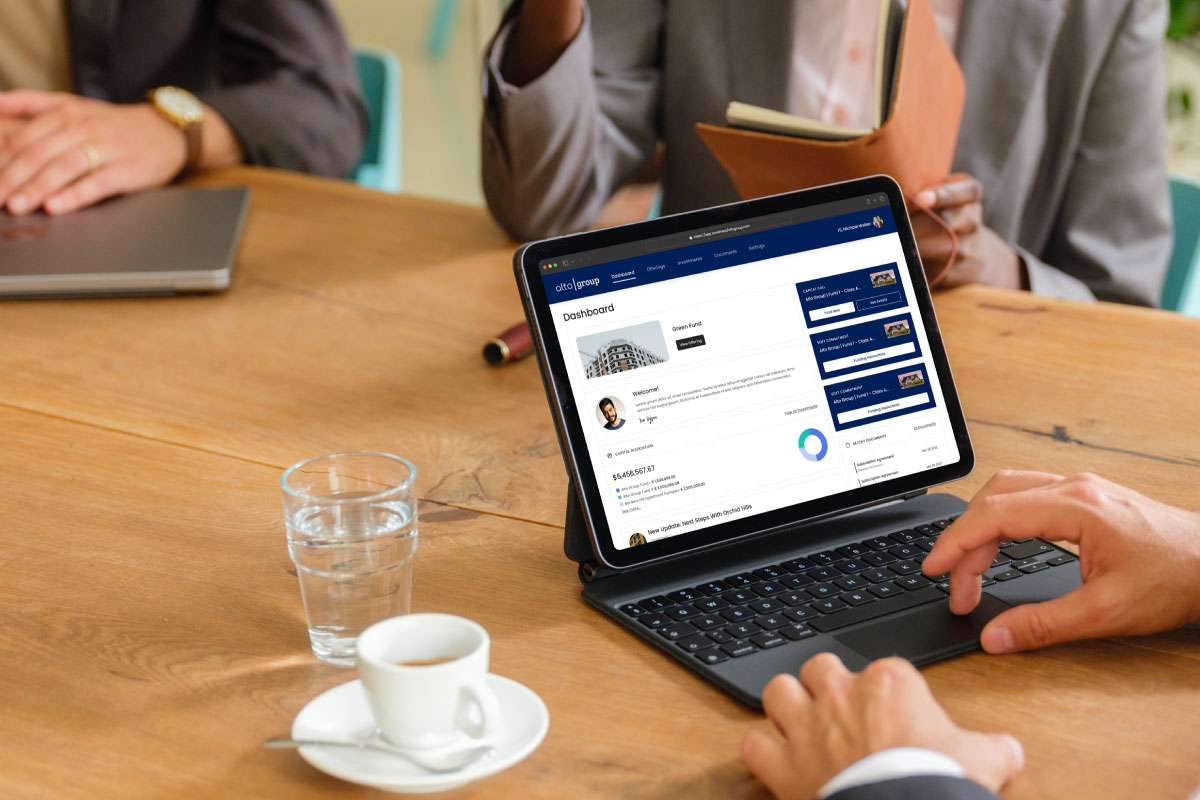

At InvestNext, we support complex fund structures with features like at-will entries, exits, and other innovations that make fund administration more manageable. Our platform provides GPs with unprecedented transparency, builds trust with their investors, and offers clear insights into how their capital is being deployed.

By embracing our end-to-end investment management solution, customers have seen remarkable performance improvements, including reduced investor accreditation processes, increased investor engagement initiatives, and growth in their investor base. We believe that blended strategies, combining syndications and fund structures, will define the new leaders in the emerging $2.66 trillion market.