G

etty Images Moneywise and Yahoo Finance LLC may earn commissions from links in this piece.

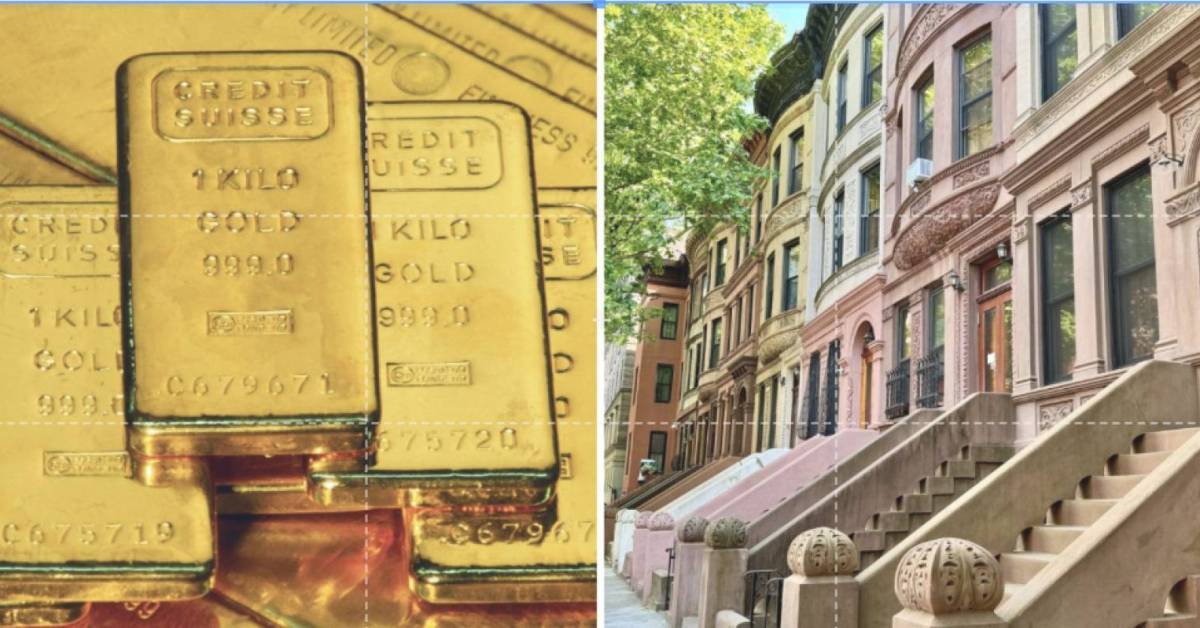

Goldman Sachs has likened gold to Manhattan real estate, noting that while the metal can’t be pumped, it can be bid out of hands. “Gold changes hands and is repriced,” the analysts wrote in a recent note. The price has surged this year, topping a record $3,700.

Thanks to Jeff Bezos, you can become a landlord for just $100—no tenants or repairs required. If you’re 49 with no retirement savings, don’t panic. Here are six quick ways to catch up, as Dave Ramsey warns that nearly half of Americans make a major Social Security mistake. Three simple steps can fix it fast.

Manhattan’s scarcity drives its high cost. As of July 2025, RentCafe reports an average rent of $5,620 for a 695‑sq‑ft unit, while Realtor.com lists homes at an average of $1.4 million. Gold is similarly limited. Wealth Advisor notes that almost all gold ever mined remains in vaults, jewelry, and central‑bank reserves. Only 1 % of the 220,000‑metric‑ton supply is added each year, so its value comes from accumulation, not consumption, like real estate. Goldman’s analysts explain that the market clears through ownership changes, not production‑versus‑use balances. “The price reflects who’s willing to hold it and who’s willing to sell,” they say. Traditional supply‑and‑demand metrics—such as raising gas prices to curb trips—don’t apply to gold because its supply is fixed.

The report also identifies two buyer categories. “Conviction buyers,” such as central banks, ETFs, and institutional investors, set the trend. “Opportunistic buyers,” mainly households in emerging markets, step in only when prices are right, providing a floor during sell‑offs.

Meanwhile, 30 % of U.S. drivers have switched car insurance in the past five years, saving significant amounts. Learn how to cut your own bills quickly.

(End of article.)