G

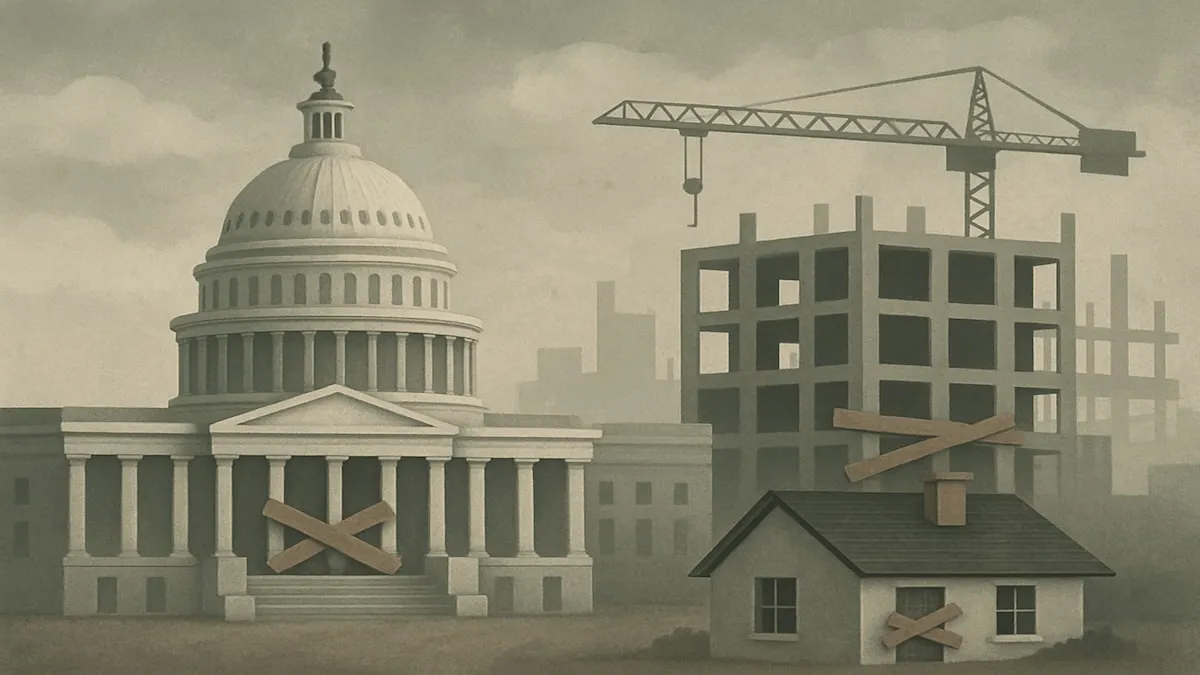

overnment shutdowns have long disrupted the housing market, delaying mortgage approvals, stalling flood‑insurance processing, and shaking buyer confidence. A federal shutdown is now only days away, threatening the paychecks of hundreds of thousands of federal employees, freezing essential data releases such as monthly employment figures, and adding uncertainty to real‑estate transactions.

Lawmakers have until Tuesday to enact a short‑term funding measure, but negotiations have stalled. Republicans favor a brief extension with no extra provisions, while Democrats insist on including health‑care measures such as extended Obamacare subsidies. Any resolution must secure bipartisan support to reach the 60‑vote threshold in the Senate. President Trump has warned that a shutdown could trigger permanent job cuts across federal agencies.

The most recent significant shutdowns—16 days in 2013 and 35 days in 2018‑19—demonstrated how federal interruptions can halt mortgage closings and impede regulatory functions essential to property transactions. “We need the government to work together and avoid another embarrassment,” said Compass Chief Evangelist Leonard Steinberg. “The last thing anyone in America wants is another reason for the country to be embarrassed by its own government.”

When federal employees are furloughed or operate at reduced capacity, processing of FHA, VA, and USDA loans slows, forcing lenders to delay closings or seek alternative financing. Flood‑insurance disruptions are especially damaging in coastal and flood‑prone states. The National Flood Insurance Program (NFIP) is used in thousands of daily closings; interruptions can halt sales that require flood coverage. The National Association of Home Builders warned that even a brief lapse could delay or cancel home and multifamily transactions needing NFIP coverage.

Meanwhile, the National Hurricane Center predicts a Caribbean disturbance could evolve into Tropical Storm Imelda by the weekend, potentially affecting U.S. coasts, while Hurricane Humberto is intensifying northeast of the Leeward Islands. “Uncertainty is the curse of all markets,” Steinberg noted. “I don’t know if this will be better or worse than past years, but no American wants a shutdown.”

Consumer confidence is a key driver of market activity. Lawrence Yun, chief economist at the National Association of Realtors (NAR), has repeatedly cautioned that shutdowns add unnecessary complications to the purchase process. “It’s fundamentally a confidence issue,” Yun said in 2019. “People are worried about the economy and the perception of chaos in Washington, which hampers major decisions like buying a home.” In 2013, Yun called the shutdown an “artificial obstacle to recovery.”

The mortgage sector’s vulnerability is clear. Steinberg explained that 90% of mortgages route through Fannie Mae and Freddie Mac, which are indirectly affected by IRS approvals and clearances during a shutdown. While the process may not halt entirely, it can slow, and any delay is undesirable for the housing market.

Not all regions feel the impact equally. Some lenders and agencies have contingency plans that keep automated systems running even with reduced staff, and brief shutdowns rarely leave a lasting mark on national sales or prices. A 2019 NAR survey found that while specific deals were delayed or lost, the overall effect on national home‑sales statistics was mixed. Markets heavily reliant on federal employment or NFIP policies—particularly coastal areas—tend to experience shutdown pain more quickly.

Steinberg urges real‑estate professionals to remain calm and rely on data rather than emotion. “We must go back to facts and data,” he said. “While it’s nerve‑racking, the reality is that outcomes are often resolved at the last minute. Those in the mortgage and real‑estate world are accustomed to negotiation and last‑minute resolutions.”