G

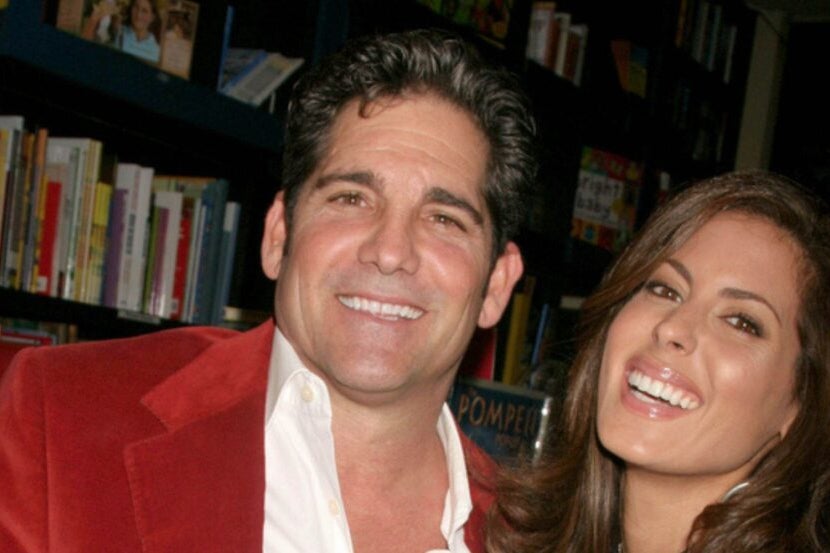

rant Cardone, founder of Cardone Capital, is bullish on the future of real estate investing through blockchain technology. As finance increasingly integrates blockchain, he sees tokenization as a way to make property investments more accessible to the public. He will discuss this topic at Benzinga's Future of Digital Assets event.

Real estate tokenization could lower barriers to entry for investors by allowing fractional ownership, Cardone believes. This approach would give a broader range of people access to real estate investing, historically dominated by institutions and wealthy individuals.

Regulatory uncertainty remains a major obstacle, however. "The biggest hurdle is regulation by the SEC," Cardone said, noting that the agency has been slow to provide clarity on blockchain regulations. Without proper guidelines, even established investors like Cardone are hesitant to fully leverage blockchain for real estate.

Cardone recently tested blockchain technology by listing a high-value property on a platform, with promising results. "Blockchain transactions are a game-changer for residential and commercial real estate," he said, but acknowledged that this disruption may be unsettling for regulators and traditional firms.

At the Benzinga Future of Digital Assets event, Cardone will explore how blockchain could transform real estate investing. He is focused on regulatory progress as key to unlocking blockchain's full potential in the market.