H

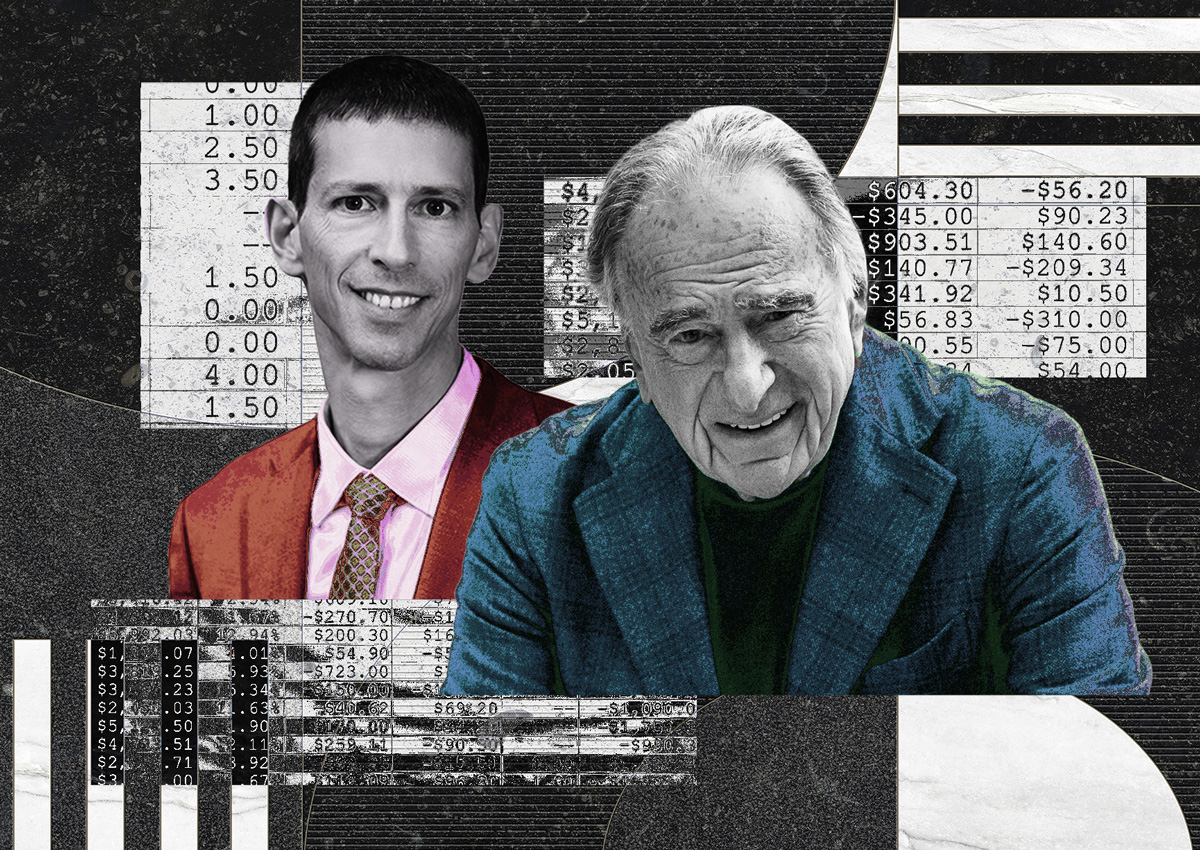

arry Macklowe is fighting a lender's plan to cash in on his stake in two real estate investment trusts, which could trigger "hundreds of millions" in capital gains taxes. Two entities tied to the developer are suing Israel Discount Bank of New York to stop the redemption of about $20 million worth of Operating Partnership units. The units were pledged as collateral for a defaulted loan of $89.5 million.

The lawsuit claims that redeeming the units would cause "irreparable and irreversible damage" to Macklowe's finances, far exceeding the value of the collateral itself. According to the complaint, Macklowe acquired the units after selling a large office building years ago to defer capital gains taxes. The bank alleges that Macklowe defaulted on the loan in March 2023, but entered into a forbearance period that was later extended.

Macklowe had hoped to repay some of the debt by selling his East Hampton estate, but the sale has been delayed due to unpaid fines and legal issues. Despite expecting to settle the debt by December, the deadline passed without resolution, prompting the bank to threaten redemption unless the debt was repaid by January 13. The lawsuit describes this threat as "rash and disastrous" and accuses the bank of pursuing a vindictive course rather than seeking the greatest return on investment.