H

ome sellers are increasingly pulling their listings off the market rather than negotiate lower prices. Delistings surged 47% nationally in May compared to a year earlier, according to Realtor.com's economic research team. This trend is partly driven by the growing inventory of active homes, which rose 28% in June from last year.

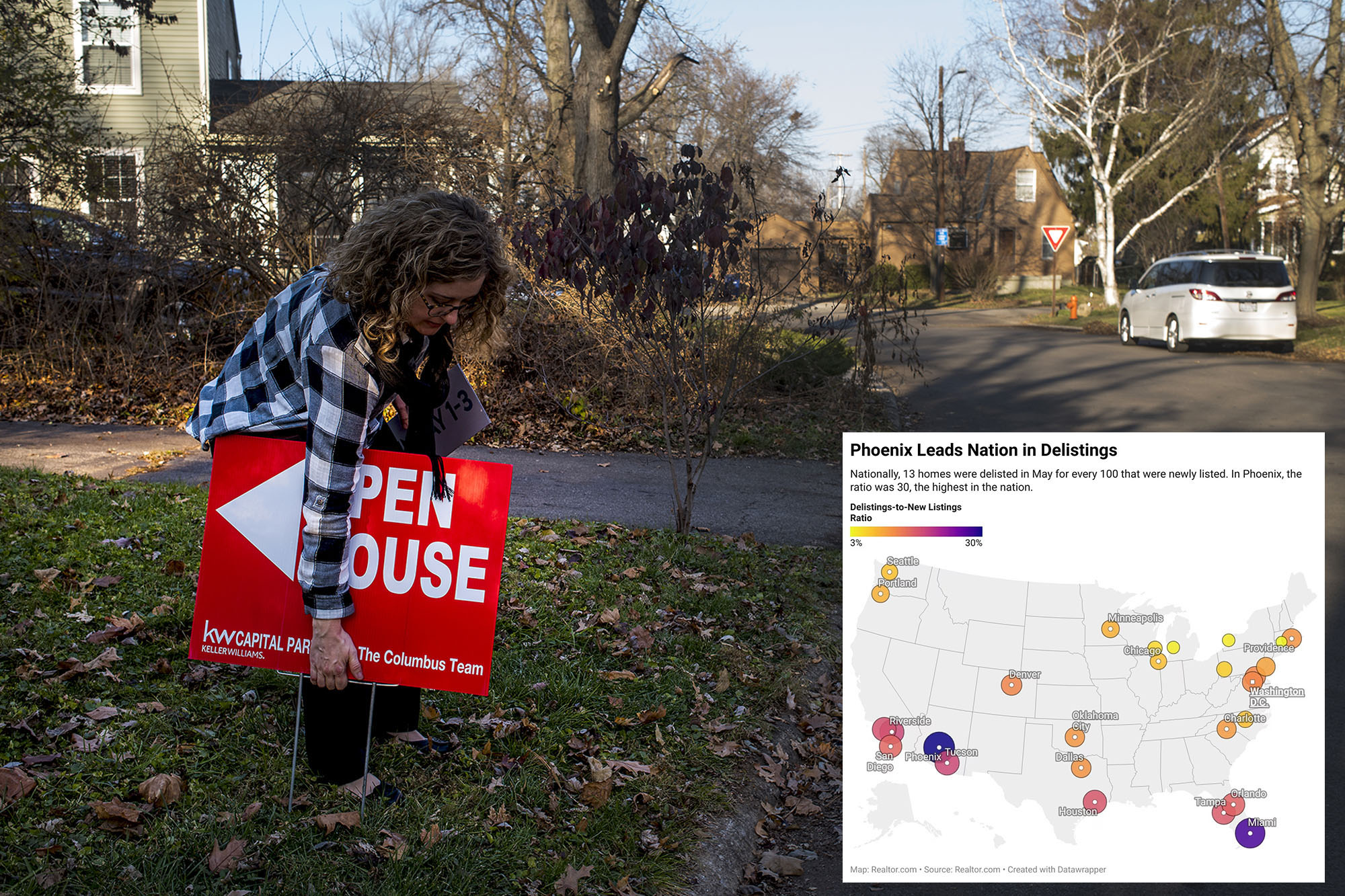

Newly listed homes increased 8.8% from a year ago, but delistings are outpacing new listings. In May, for every 100 homes that hit the market, 13 were delisted, up from 10 in spring 2024 and 2023, and six in 2022.

Sellers with unrealistic price expectations are facing a softer market with limited buyers, leading to a surge in price reductions. Realtor.com senior economist Jake Krimmel notes that homeowners benefit from record-high levels of home equity, giving them the flexibility to wait out the market if their asking price isn't met.

The trend is particularly noticeable in the South and West, where inventory has surged back above pre-pandemic levels and prices are flat or falling. Phoenix led the nation in delistings in May, with 30 homes pulled from the market for every new home listed.

Nationally, 20.6% of home listings had price reductions in June, up 2.2 percentage points from last year. This is the highest June share in Realtor.com data going back to at least 2016. The national median list price held steady at $440,950 last month, underscoring that many sellers are still expecting peak-era prices.

In contrast, buyers are seeing more choices than they've had in years, with active listings topping 1 million for the second straight month in June. Inventory grew in all four major U.S. regions, with the West seeing a 38% jump and the South up nearly 30%. Homes are also staying on the market longer, with median days on the market increasing to 53 days.