I

n Q2 2025 the Federal Reserve’s Flow‑of‑Funds report shows a sharp rebound in the housing market. Owner‑occupied real estate hit a record $49.3 trillion, up $1.3 trillion from the previous quarter and the first quarterly gain in a year. Home values have more than doubled since mid‑2016, and the sector added $546.2 billion over the last 12 months.

Mortgage debt also climbed, reaching a new high of $13.5 trillion. The quarterly increase was $107.9 billion, and year‑over‑year growth was $370.9 billion (2.8 %). Although the pace is slower than the 2017‑2019 average, it is still faster than the mid‑2021 to end‑2022 trend, which was roughly twice as high.

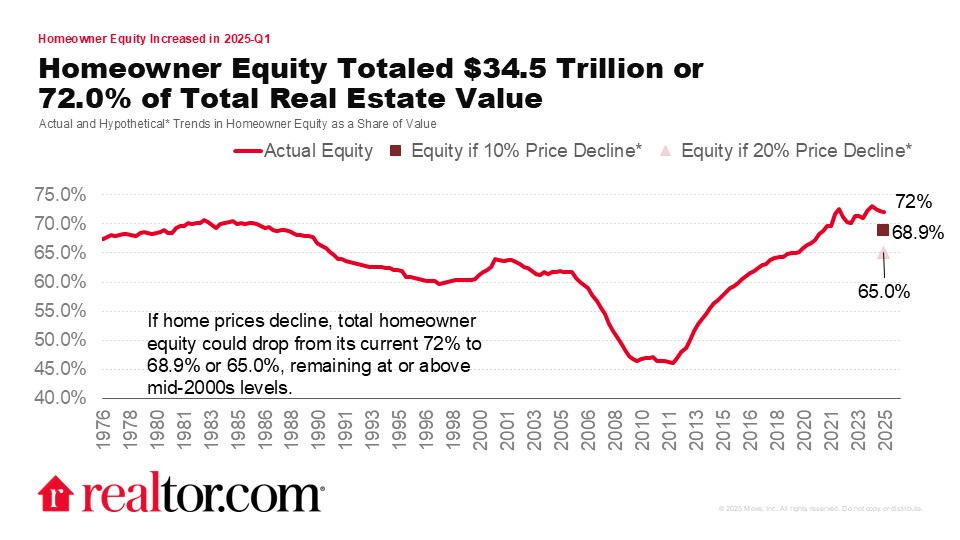

Home equity surged to an all‑time peak of $35.8 trillion, rising $1.2 trillion in the quarter and $175.3 billion over the year. Equity now represents 72.6 % of total real‑estate value—higher than any period between 1961 and 2023, though slightly below the 2024 level. This figure reflects aggregate household equity; individual balances will vary.

The elevated equity cushion offers resilience: a sudden 10 % decline in home prices would leave homeowners with 69.5 % equity, comparable to mid‑2021 levels, while a 20 % drop would still leave 65.7 % equity, similar to late 2019‑early 2020.

For the complete Flow‑of‑Funds data, visit the Federal Reserve’s website.